Business Mileage Reimbursement Rate 2020

Company and use the kilometre rate method to claim business vehicle costs this new rate applies for the 2021 year. See section 404 of.

The Basics Of Employee Mileage Reimbursement Law Companymileage

The automobile allowance rates for 2020 are.

Business mileage reimbursement rate 2020. Theyre identical to the rates that applied during 2019-20. Reimbursements based on the federal mileage rate arent considered income making them nontaxable to. 575 cents per mile for regular business driving.

Also for miles driven while helping a non-profit you can reimburse 14 cents per mile. 14 rows Standard Mileage Rates. If the mileage rate you pay is no higher than the advisory fuel rates for the engine size and fuel type of the company car there will be no.

For 2020 the federal mileage rate is 0575 cents per mile. For automobiles a taxpayer uses for business purposes the portion of the business standard mileage rate treated as depreciation is 24 cents per mile for 2016 25 cents per mile for 2017 25 cents per mile for 2018 26 cents per mile for 2019 and 27 cents per mile for 2020. The following table summarizes the optional standard mileage.

59 per kilometre for the first 5000 kilometres driven 53 per kilometre driven after that In the Northwest Territories Yukon and Nunavut there is an additional 4 per kilometre allowed for travel. Handle you mileage reimbursement with the rates for 2021 and 2020. 1 2020 the standard mileage rates for the use of a.

The rates apply for any business journeys you make between 6 April 2020 and 5 April 2021. 05 cents less than 2019 For medical or moving purposes the rate has changed to 17 cents per mile. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

If youre going to reimburse employees in 2021 use the 2021 mileage rate not the prior years. 3 cents lower than last year For charitable purposes there has been no change and will remain 14 cents per mile driven. For 2020 the standard IRS mileage rates are.

The business mileage reimbursement rate is an optional standard mileage rate used in the United States for purposes of computing the allowable business deduction for Federal income tax purposes under the Internal Revenue Code at 26 USC. For 2020 the standard mileage rates are. Inland Revenue mileage reimbursement rates what you need to know.

The non-profit reimbursement rate for mileage and other travel expenses. Jan 01 2020 Beginning on January 1 2020 the standard mileage rates for the use of a car van pickup or panel truck will be. In fact the last time AMAP rates changed was in April 2012 when the AMAP rate for the first 10000 car and van miles rose from 40p per mile to.

Irs mileage rates 2021. Business Mileage Rate Decreasing in 2020 January 2 2020 D Payroll Administration Effective Jan. 575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or.

In 2019 the IRS released a report that states non-profit business mileage can be reimbursed at 58 cents per mile. 1 2020 the standard mileage rates for the use of a car including vans pickups and panel trucks are. This 2020 rate is down from 2019s 58 cents.

162 for the business use of a vehicle. Some points to be noted are. Under the law the taxpayer for each year is generally entitled to deduct either the actual expense amount or an amount computed using the standard mileage rate.

This is the one that applies to most companies. 575 per mile for business miles driven 58 per mile in 2019. 56 cents per mile driven for business use down 15 cents.

Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. 575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or moving purposes down three cents from the rate for 2019 and. 1 2021 the standard mileage rate for the business use of cars vans pickup or panel trucks will be 56 cents per mile down 15 cents from 2020.

For the business use of a car the rate has dropped down to 575 cents per mile. Reimburse employees for company car business travel. Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

575 cents per mile for business.

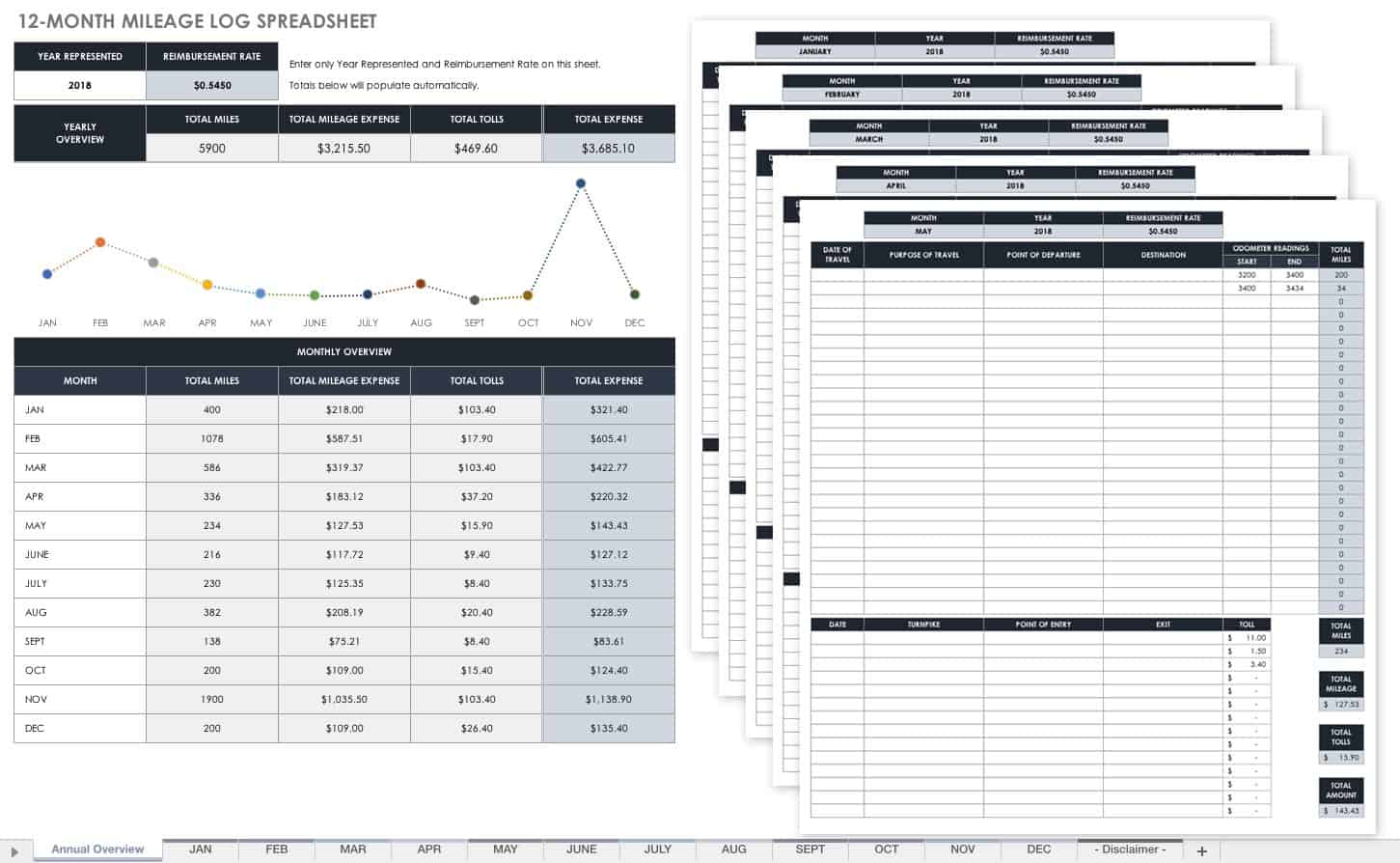

Free Mileage Log Templates Smartsheet

Irs Issues Standard Mileage Rates For 2020 Mileage Irs Eureka

Allowance Vs Cent Per Mile Reimbursement Which Is Better For Employees

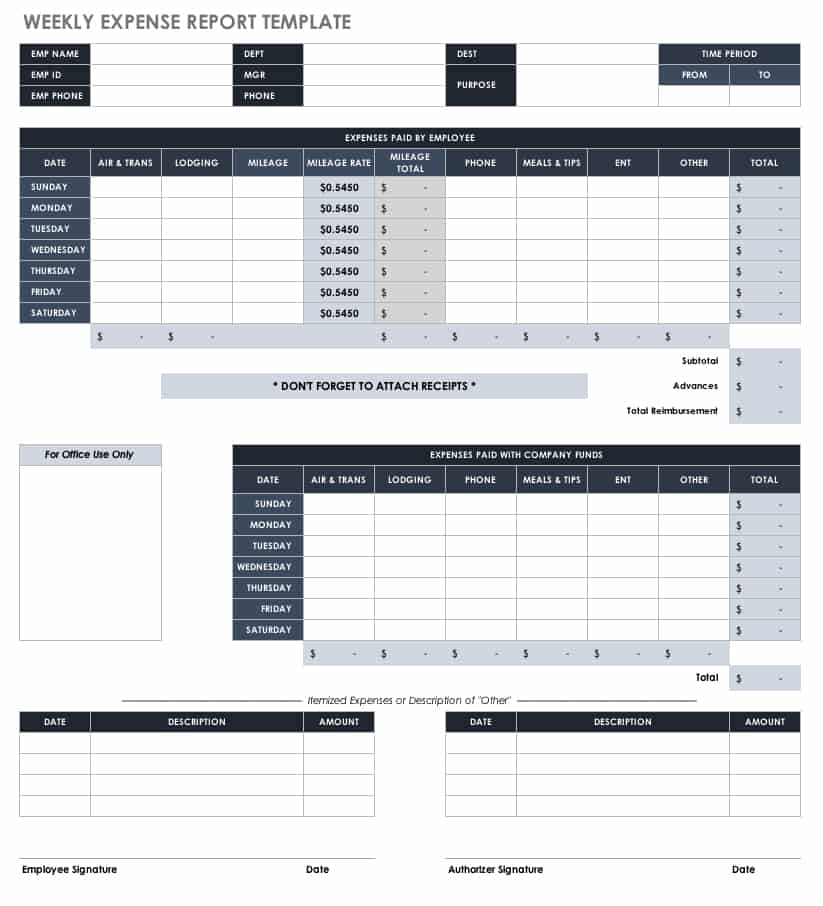

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

![]()

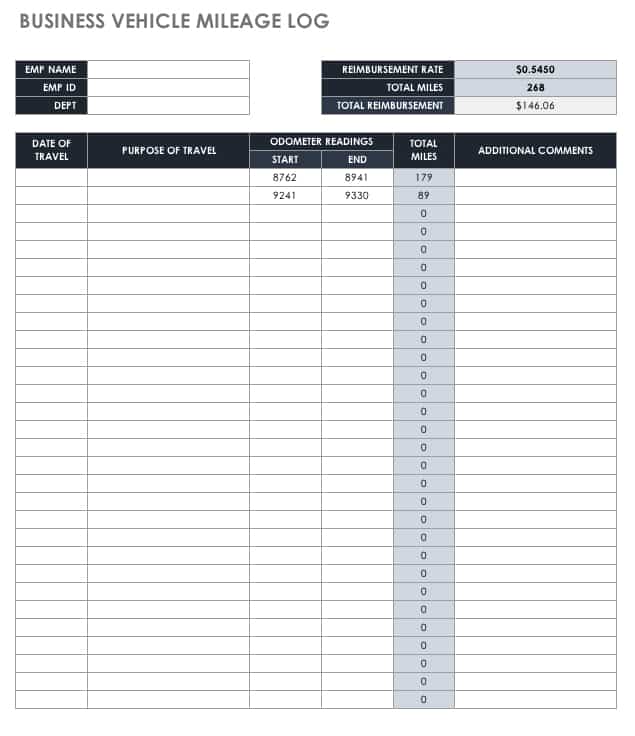

Free Mileage Tracking Log And Mileage Reimbursement Form

Instructions For Form 2106 2020 Internal Revenue Service

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

Free Mileage Log Templates Smartsheet

Https Www Gsa Gov Cdnstatic Ogp 20signed 20cy 2020 Pov Mileage Rate Bulletin 12 9 2019 Pdf

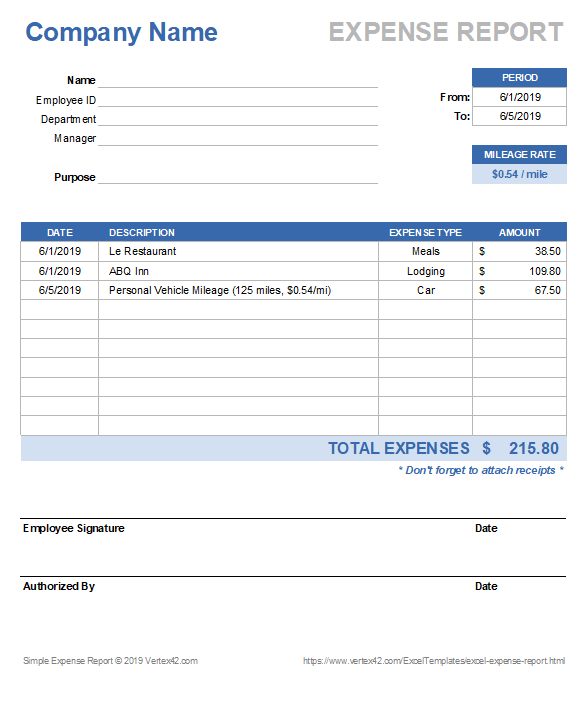

Free Expense Reimbursement Form Templates

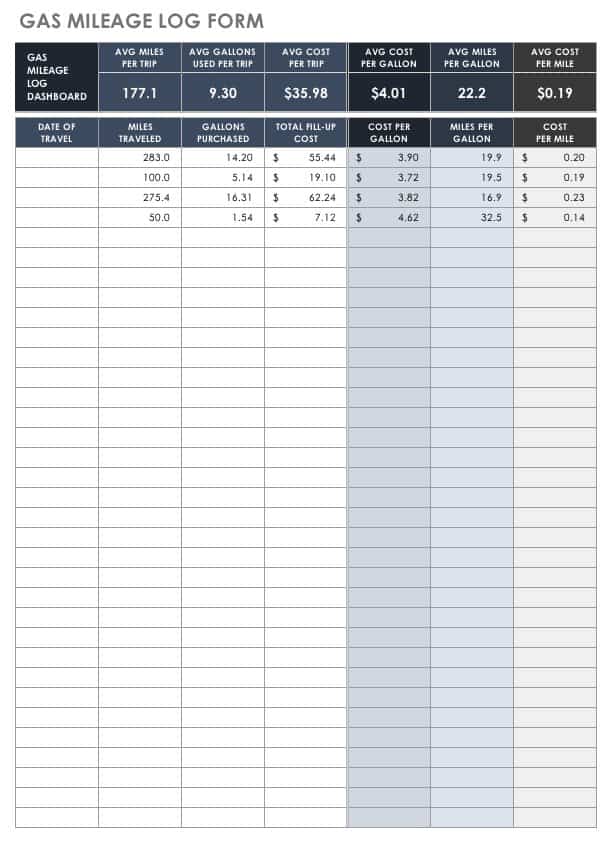

Free Mileage Log Templates Smartsheet

Allowance Vs Cent Per Mile Reimbursement Which Is Better For Employees

Free Mileage Log Templates Smartsheet

The Basics Of Employee Mileage Reimbursement Law Companymileage

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

The Basics Of Employee Mileage Reimbursement Law Companymileage

Post a Comment for "Business Mileage Reimbursement Rate 2020"