Business Mileage Depreciation Rate 2020

Business standard mileage rate treated as depreciation is 24 cents per mile for 2015 24 cents per mile for 2016 25 cents per mile for 2017 25 cents per mile for 2018 and 26 cents per mile for 2019. You cannot use the standard mileage rates if you claim vehicle depreciation.

Guide To 2021 Irs Mileage Rates Quickbooks

Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

Business mileage depreciation rate 2020. 575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or. Depreciation Generally the Modified Accelerated Cost Recovery System MACRS is the only depreciation method that can be used by car owners to depreciate any car placed in. The business cents-per-mile rate is adjusted annually.

To calculate your deduction you multiply the business standard mileage. To determine the number of miles driven for business you need two numbers for each business vehicle. Instead a portion of the rate is applied equaling 27 cents-per-mile for 2020.

This form is used to file for Depreciation and Amortization and contains useful information about when how and why to file. The standard mileage rate for 2020 Beginning on January 1 2020 the standard mileage rate for the business use of a car van pickup or panel truck is 575 cents per mile. Business standard mileage rate treated as depreciation is 24 cents per mile for 2016 25 cents per mile for 2017 25 cents per mile for 2018 26 cents per mile for 2019 and 27 cents per mile for 2020.

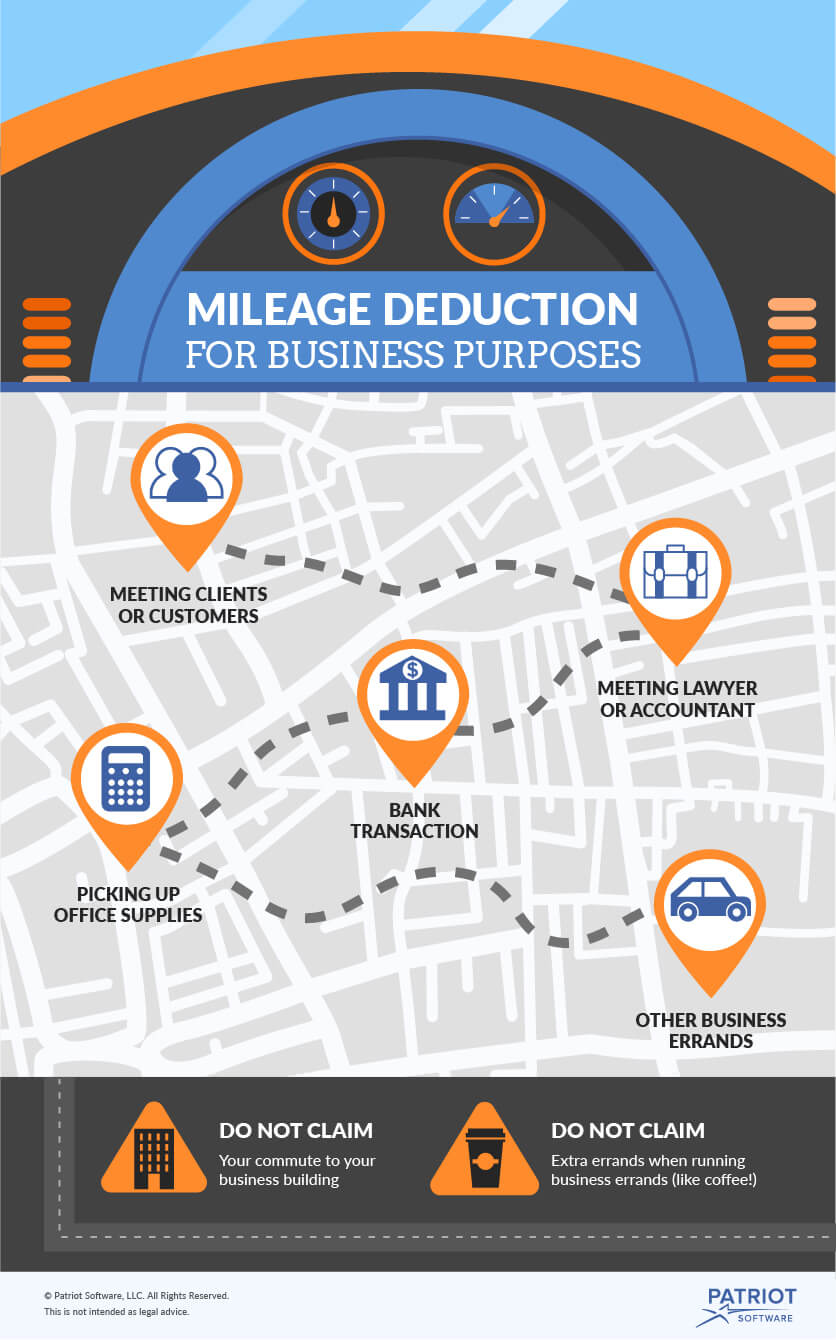

To learn more about depreciation click here to view a list of tax forms and find Form 4562. Calculating your Business IRS Standard Mileage Deduction The 2020 standard mileage rate for transportation expenses is 575 cents per mile for all miles driven for business purposes. 1 2020 the standard mileage rates for the use of a car van pickup or panel truck are.

Other car expenses for parking fees and tolls attributable to business use are separately deductible whether you use the standard mileage rate or actual expenses. But is not limited to business review and analysis requirements Section 53041d to support that the business has sufficient liquidity and is financially capable of producing stable monthly income for. 16 cents per mile was 17 cents in 2020 Charity.

For tax year 2020 the Standard Mileage rate is 575 centsmile. Uber makes it easy to track your online miles. 575 cents per mile for business miles driven down from 58.

The amount of car and truck expense reported on Schedule CC-EZ Schedule E or Schedule F is the either the total of the actual expenses or a calculation based on the business mileage multiplied by the prevailing standard mileage rate. The mileage rate for the 2019 tax year is 058 per mile driven. 575 cents per mile driven for business use 17 cents per mile driven for medical or moving purposes down three cents from the 2019 rate 14 cents per mile driven.

For automobiles a taxpayer uses for business purposes the portion of the business standard mileage rate treated as depreciation is 24 cents per mile for 2016 25 cents per mile for 2017 25 cents per mile for 2018 26 cents per mile for 2019 and 27 cents per mile for 2020. Carrying through the example above. If you use a car or truck for in your business you ordinarily can deduct expenses related to the car or truck.

It was 58 cents for 2019 and 545 cents for 2018. As of January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks are. 575 cents per mile for business miles driven down5 cents from 2019 17 cents per mile driven for medical or moving purposes down 3 cents from 2019.

Yes if you used the Standard Mileage Rate in 2019 and use the Actual Expenses in 2020 you can switch back to the Standard Mileage Rate in the future. 56 cents per mile was 575 cents in 2020 Medical Moving. Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

5000 business miles x 0575 standard rate 2875 Standard Mileage deduction. See section 404 of. The total number of miles driven during the year The total number of miles driven just for business.

575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or moving purposes down three cents from the rate for 2019 and. The IRS allows employees and self-employed individuals to use a standard mileage rate which for 2020 business driving is 575 cents per mile. 14 cents per mile was 14 cents in 2020.

X Depreciation Rate 2020-27 and 2019-26 Total Mileage Depreciation Subtotal from Schedule C Business 1 Page 1 of 6.

Free Mileage Log Templates Smartsheet

Standard Mileage Rates For 2020 Dalby Wendland Co P C

Irs Issues Standard Mileage Rates For 2020 Mileage Irs Eureka

Your Guide To 2020 Irs Mileage Rate I T E Policy I

Deducting Automobile Business Costs Strategic Finance

Mileage Tracker Mileage Rates Deductions Quickbooks Small Business Tax Deductions Business Tax Deductions Tax Deductions

Guide To 2021 Irs Mileage Rates Quickbooks

What Are The Irs Mileage Rates Updated 2021 Bench Accounting

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

The 2020 Irs Mileage Rate And Business Vehicle Reimbursements

2021 Irs Business Mileage Rate Of 56 Cents Calculated Using Motus Data

Top 5 Measurements The Irs Uses To Determine Mileage Rate

The Deductible Mileage Rate For Business Driving Decreases For 2020

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Irs Announces Standard Mileage Rates For 2014 Small Business Trends Irs Tax Deductions Small Business Trends

Your Guide To 2020 Irs Mileage Rate I T E Policy I

Https Apps Irs Gov App Vita Content Globalmedia Teacher Schedule C Business Income 4012 Pdf

What Do Most Companies Pay For Mileage Reimbursement

The 2020 Irs Mileage Rate And Business Vehicle Reimbursements

Post a Comment for "Business Mileage Depreciation Rate 2020"