Business Tax Id Malaysia

Copy of the partnership business registration certificate issued by the Companies Commission of Malaysia SSM 5. Of Malaysia IRBM are assigned with a Tax Identification Number TIN known as Nombor Cukai Pendapatan or Income Tax Number ITN.

Account Tax Identification Numbers

Any business with a yearly turnover in excess of MYR 500000 is required to register for VAT in this country.

Business tax id malaysia. This applies to advertisers whose Sold To country on their business or personal address is set to Malaysia. Malaysia and the United States had on 30 June 2014 reached an agreement in substance on a Model 1 IGA to implement the Foreign Account Tax Compliance Act FATCA. Particulars Of Change Or Alteration Relating To Foreign Company under subsection 567 1 Companies Act 2016.

Starting from January 2021 all Malaysians above the age of 18 and corporate entities will be assigned a Tax Identification Number TIN said Deputy Finance Minister Datuk Amiruddin Hamzah in his address at the Malaysia Tax Policy forum. However there are individuals and entities who are. Find tax information and tools for businesses including Employer ID Number EIN Employment Tax Estimated Tax and the Foreign Account Tax Compliance Act FATCA.

Copy of the notice of registration of the conversion to LLP under section 32 of the Limited Liability Partnership Act. It is also commonly known in Malay as Nombor Rujukan Cukai Pendapatan or No. Picture by Ahmad Zamzahuri.

Lembaga Hasil Dalam Negeri Malaysia classifies each tax number by tax type. The most common tax reference types are SG OG D and C. Add your service tax identification number in the Ad Accounts Settings of Ads Manager.

Tax Identification Number to be introduced in Jan 2021 says deputy finance minister. Latest Salary Slip Employed Obtaining an Income Tax Number. This business registration numbers are set of numbers used to identify a company and this number will be printed on the companys certificate of incorporation.

Supporting Documents If you have business income. An Income Tax Number or Tax Reference Number is an unique identifying number used for tax purposes in Malaysia. If it is neither the holding company nor surrogate holding company the Malaysian entities must notify the tax authorities of the identity and tax residence of the entity responsible for preparing the CbC report.

The Income Tax Number is allocated by the Inland Revenue Board of Malaysia when you register for tax. This will help ensure that residents with financial accounts in other countries are complying with their domestic tax laws and act as a deterrent to tax evasion. If you do not have business income.

Beginning 1 January 2020 Facebook ads in Malaysia are subject to a service tax at the applicable local tax rate. The fixed rate is 6 and some types of goods and services can be exempt from this tax while others are taxed at different rates. Malaysia has committed to exchange the CRS information from 2018 and would also be receiving financial account information on Malaysian residents from other countries tax authorities.

Usually business registration numbers are also regarded as company registration numbers. The government is looking to introduce the use of tax identification numbers for those aged 18 and above by 2021. Every company in Malaysia has a business registration number.

Corporate income tax in Malaysia is applicable to both resident and non-resident companies. Bernama pic PETALING JAYA. You dont have to enter a service tax identification number.

The Inland Revenue Board of Malaysia Malay. Experts say the governments plan to introduce tax. Companies are taxed at the 24 with effect from Year of Assessment 2016 while small-scale companies with paid-up capital not exceeding RM25 million are taxed.

Deputy Finance Minister Datuk Amiruddin Hamzah says the government will introduce a Tax Identification Number TIN for business or individual income earners aged 18 and above beginning in January 2021. Although not signed Malaysia has however been included in the US Treasurys list of jurisdictions that are treated as having an IGA in effect with the United States.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

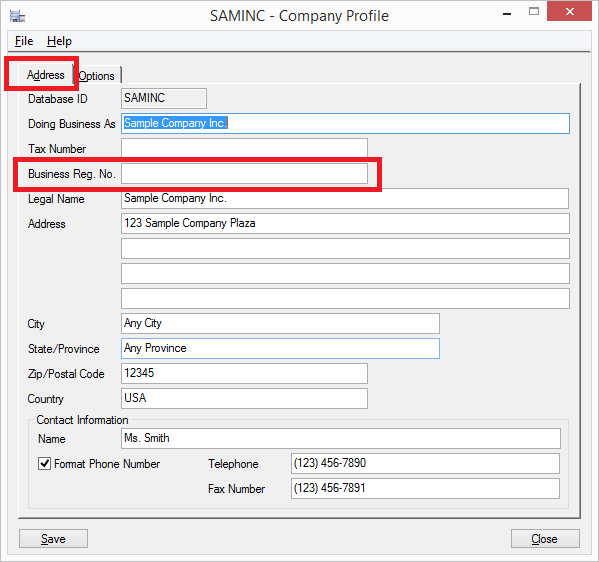

Business Registration Number In Sage 300 Sage 300 Erp Tips Tricks And Components

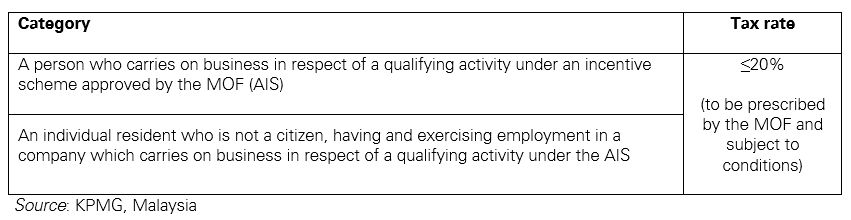

My Tax Measures Affecting Individuals In Budget 2021 Kpmg Global

Account Tax Identification Numbers

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Individual Income Tax In Malaysia For Expatriates

8 Types Of Business Entities To Register In Malaysia

Beginner S Tax Guide For Online Businesses In Malaysia Free Malaysia Today Fmt

Malaysia Sst Sales And Service Tax A Complete Guide

How To Step By Step Income Tax E Filing Guide Imoney

Tips For Income Tax Saving L Co Chartered Accountants

Malaysia Sst Sales And Service Tax A Complete Guide

Ein Vs Dun Bradstreet D U N S Number

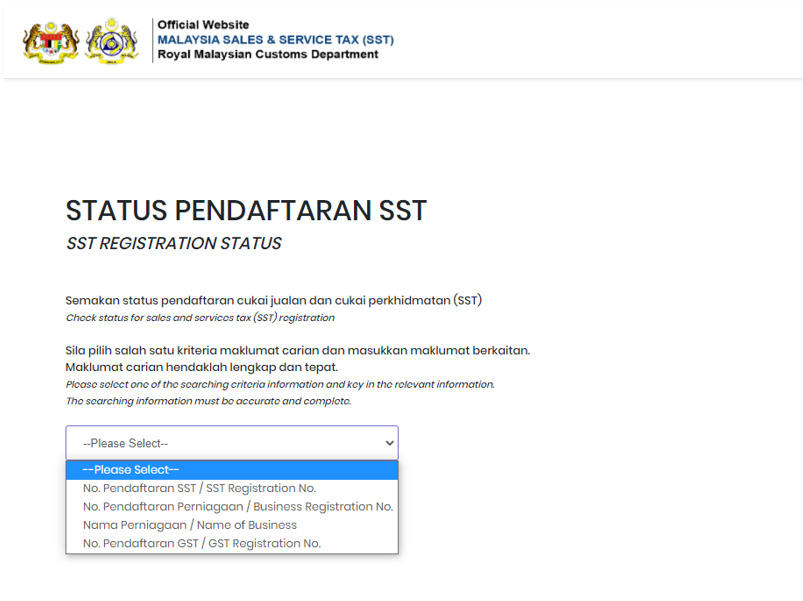

How To Check Sst Registration Status For A Business In Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Sst Sales And Service Tax A Complete Guide

Post a Comment for "Business Tax Id Malaysia"