Business Definition Hostile Takeover

Acquiring companies that pursue a hostile. 103 Characteristics of Targets of Hostile and Friendly Takeovers corn-madeThus initial rejection by the targets board is taken as evidence Ltion of the bidders hostility as is active management resistance to the bidistic escape to a white knight or a management buyout in response to unsolicited pressure.

All You Need To Know About Hostile Takeovers In M A

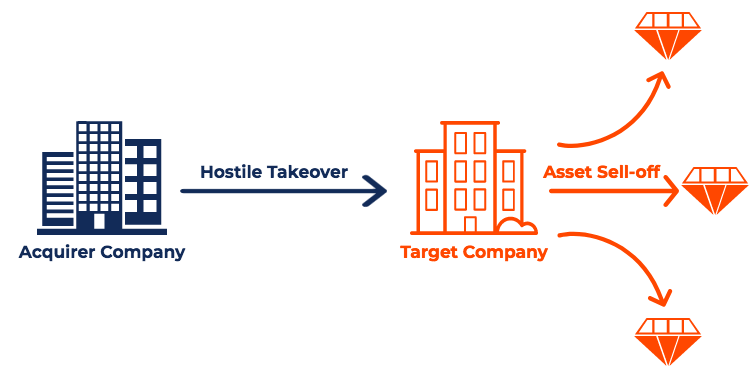

In the process of a corporate takeoverparticularly a hostile takeover outside acquirers may attempt to convince existing shareholders to vote out some or all of a companys senior management to.

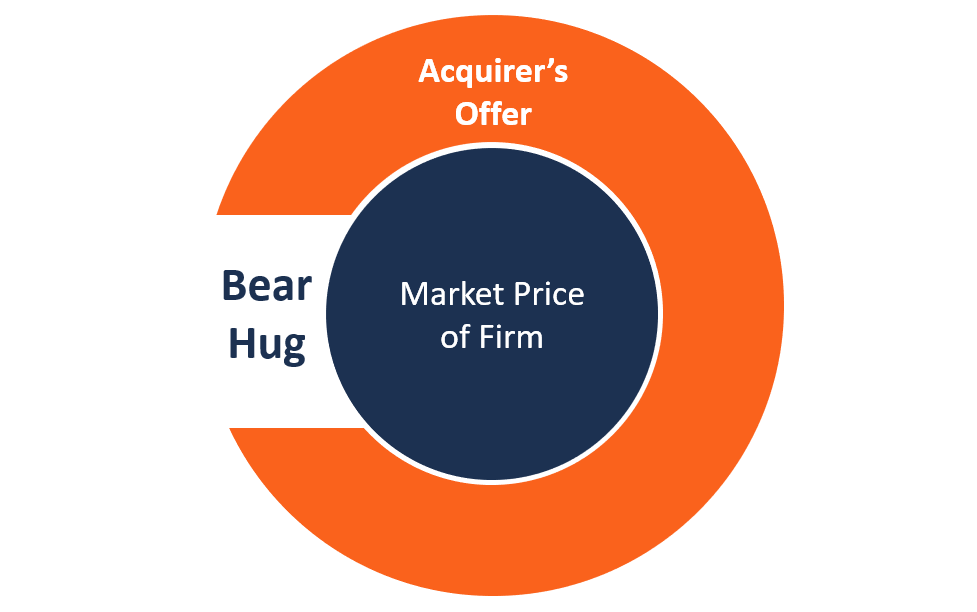

Business definition hostile takeover. How a Hostile Takeover Works In a hostile takeover the target companys board of directors rejects the offer but the bidder continues to pursue the acquisition. A takeover is considered hostile if the target companys board rejects the offer and if the bidder continues to pursue it or the bidder makes the offer directly after having announced its firm intention to make an offer. Development of the hostile tender is attributed to Louis Wolfson.

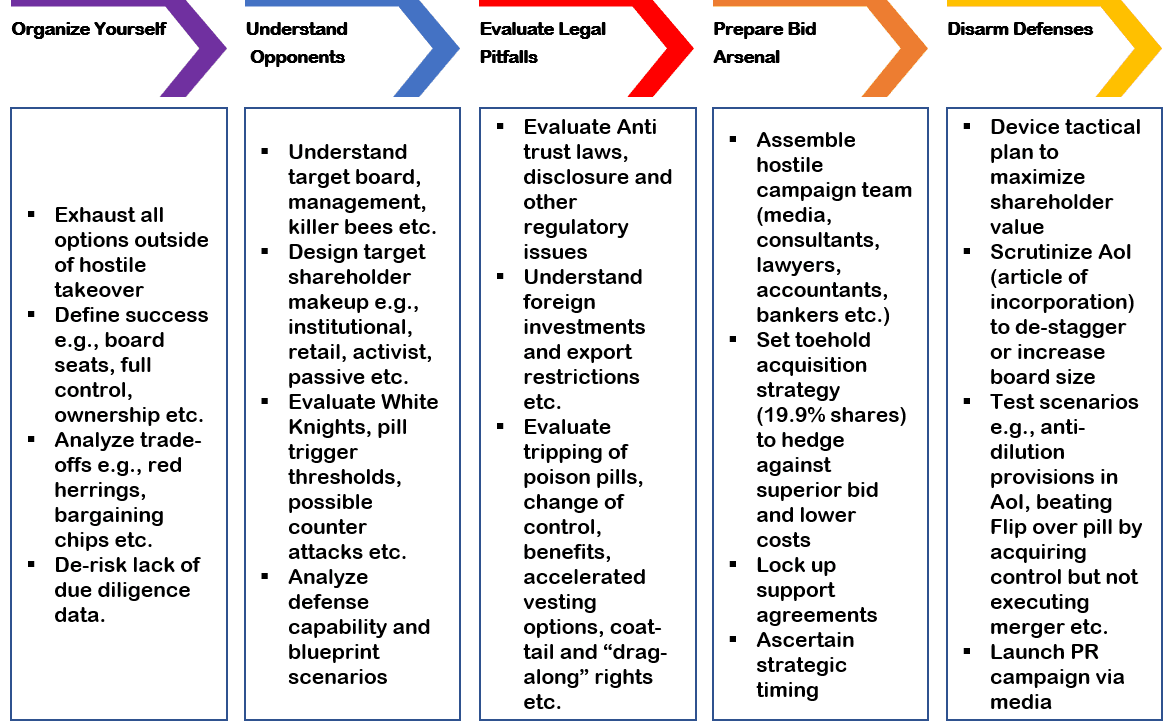

There is also no time for training on the job. We sort acquisitions on the basis of the initial. Hostile takeover bids are bet the company situations and by their nature are a threat to the survival of the company.

Most mergers and acquisitions happen through a mutual agreement. A hostile takeover is when one company acquires another against the wishes of the target companys board andor management. Therefore companies should assemble a response team during peacetime to be on standby in the event of an attack.

A hostile takeover is the opposite of a friendly takeover in which both parties to the transaction are agreeable and work cooperatively toward the result. A hostile takeover can be conducted in several ways. A hostile takeover is a type of corporate acquisition or merger which is carried out against the wishes of the board and usually management of the target company.

Private Equity And Venture Capital Course Venture Capital Equity Capital Cash Flow Statement

Takeovers Definition Types Friendly Hostile Reverse Backflip

Takeover Bid Definition Types Of Takeovers Examples

All You Need To Know About Hostile Takeovers In M A

Crown Jewel Defense Hostile Takeover Defense In M A Transactions

American Depository Receipt In 2021 Financial Management Financial Strategies Budgeting Money

Bear Hug Definition How It Works Reasons For A Takeover

All You Need To Know About Hostile Takeovers In M A

Mergers Data Science Learning Budgeting Finances Financial Strategies

Attempt To Remain Relevant By Merging Bsnl And Mtnl M A Critique Goods And Services Goods And Service Tax Wireless Service

What Is A Takeover Definition Types And Examples Market Business News

Tobin S Q Ratio Financial Management Financial Strategies Business Money

Share Buyback Money Management Advice Accounting And Finance Learn Accounting

All You Need To Know About Hostile Takeovers In M A

/mergers-and-acquisitions-8c2a3e229ac2485c882b76b17fe40a4b.jpg)

:max_bytes(150000):strip_icc()/GettyImages-530018925-09ea11625b5c43f088cd276f55294e5f.jpg)

:max_bytes(150000):strip_icc()/business_meeting_-5bfc31ccc9e77c0026b6244c.jpg)

Post a Comment for "Business Definition Hostile Takeover"