How Do I Write A Reasonable Cause Letter To The Irs

And like high school the irs has its own permanent record in which the internal revenue service tracks your misdeeds. Picture of house burned down in fire.

5 1 12 Cases Requiring Special Handling Internal Revenue Service

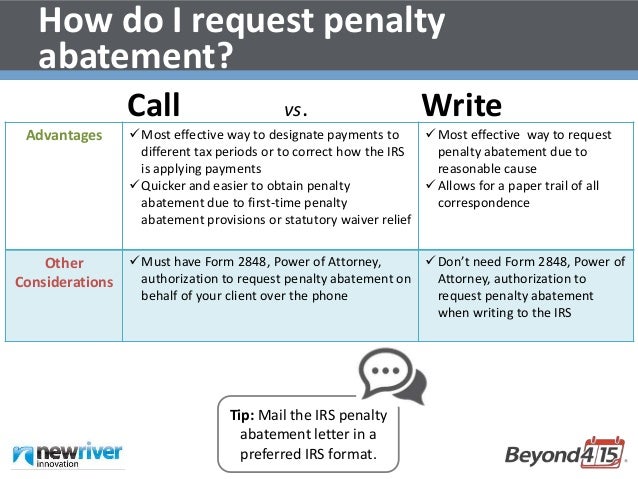

If you were affected by the pandemic or other circumstances the IRS may be able to remove or reduce some penalties due to reasonable cause but only if you tried to comply with the tax law but were unable to due to facts and circumstances beyond your control.

How do i write a reasonable cause letter to the irs. In this part of the letter you want to discuss the applicable law and authority. Make sure to cite any authority that provides for the abatement of penalties. 1 for failure to file a tax return and failure to pay under Sec.

In this video I analyze a letter written to the IRS by a tax-exempt organization to request abatement for penalties assessed for late filing of the organizat. If you do this properly you will have essentially done the IRS agents job for him. Irs penalty abatement reasonable cause letter sample.

IRS tax interest that is due on an additional liability that was not identified by the IRS in a timely manner IRS 6404g A Taxpayer can never argue reasonable cause or extenuating circumstances to abate IRS tax interest. Insurance notice of theft of private property and documents. IRS must determine if the taxpayers reason addresses the penalty imposed.

Taxpayers generally bear the burden of proof to establish reasonable cause 2. Letter from a doctor stating the conditions of your illness that prevented you from filing or paying. Wait for the IRS to assess the penalty and then send a reasonable cause explanation to the address indicated on the notice from the IRS.

Each reasonable cause request must be evaluated on its own merit 3. Internal Revenue Service use the address provided in your tax bill Re. If you already filed your income tax forms paid the tax and the penalties use IRS Form 843 Claim for Refund and Request for Abatement and attach a cover letter requesting penalty abatement relief and.

Letter 12 - This letter is actually designed to be an attachment to Form 1023 to explain why there was a reasonable cause for not filing returns for three consecutive years which resulted in the loss of tax-exempt status. 3 for failure to file Form 1099 or other information reporting returns under Sec. The authority should include the IRS any court cases specific IRS policy statements regulations and IRM procedures.

Any other proof or supporting documents. Reasonable-cause exceptions also apply to other penalties the IRS can impose including the penalties. This way you mitigate all sorts of procedural kerfuffles.

6651 2 for making an erroneous claim for refund or tax credit under Sec. Guidance to IRS Employees. Here is a simplified IRS letter template that you can use when writing to the IRS.

The following types of penalty relief are offered by the IRS. How to Write a Letter of Explanation to the IRS With Samples If you are requesting a penalty abatement for a reasonable cause you can use the sample letter below to help write your request. An affirmative showing of reasonable cause must be made in the form of a written statement containing a declaration that it is made under the penalties of perjury setting forth all the facts alleged as a reasonable cause Of course there are many more things that go into a successful letter which is more art than science.

Irs penalty abatement reasonable cause letter sample. I am writing to respectfully request the abatement of penalties totaling ENTER DOLLAR AMOUNT that was assessed related to the attached notice dated ENTER DATE OF NOTICE. If this applies to you and you have the necessary documentation to support your claim you can call the toll-free number on your IRS notice or write a letter to request penalty relief due to reasonable cause.

Please accept my petition for abatement of penalties owed for reasonable cause. A Taxpayer can use reasonable cause and several other options to request abatement of penalties. Angelo state when writing appeal letter penalty abatement letter asking.

This statement conforms to IRS Revenue Procedure 2014-11 and is an actual statement that was successful in achieving retroactive reinstatement for a small 501c3 association. IRS Reasonable Cause Letter Sample. To do this your penalty abatement letter needs to clearly state the facts of your case cite the relevant law then apply the law to the facts coming to the conclusion that reasonable cause relief is warranted.

Cite any Applicable Laws. You should always address this correspondence to the Internal Revenue Service and send it to the address listed on the written notice of the tax due.

Request To Waive Penalty Request For Waiver Of Penalty For Delinquency Under Debt And Enforcement Click On Request For Waiver Of Penalties And Interests Coretanku

5 1 12 Cases Requiring Special Handling Internal Revenue Service

Sample Letter To Waive Penalty Charges Sample Letter Waiver Of Penalty For Reasonable Cause

Reasonable Cause Form 3520 Reporting Post Diirsp Update

5 1 12 Cases Requiring Special Handling Internal Revenue Service

3 12 220 Error Resolution System For Excise Tax Returns Internal Revenue Service

4 46 4 Executing The Examination Internal Revenue Service

5 1 12 Cases Requiring Special Handling Internal Revenue Service

5 1 12 Cases Requiring Special Handling Internal Revenue Service

Request To Waive Penalty Request For Waiver Of Penalty For Delinquency Under Debt And Enforcement Click On Request For Waiver Of Penalties And Interests Coretanku

32 1 1 Overview Of The Regulations Process Internal Revenue Service

Irs Audit Letter 692 Understanding Irs Audit Letter 692

Post a Comment for "How Do I Write A Reasonable Cause Letter To The Irs"