Can I Buy Property With My Limited Company

Advantages of buying through a limited company. Whether or not to invest in a property through your limited company needs carefully consideration.

How To Buy Investment Property Using An Llc And Get A Loan With Llc Real Est Real Estate Investing Rental Property Real Estate Investing Wholesale Real Estate

However by putting it through your limited company you will only be subject to pay corporation tax at 20.

Can i buy property with my limited company. Property investors over the years have decided to move their property portfolios into limited companies because of regulations around tax brought in y the government. The main reason for buying a residential property through a limited company is tax efficiency. Tax experts will likely advise not to transfer existing ownership to a limited company but to buy future properties under the limited company instead.

Transferring is not a legal option. You have family members who you would like to share the income with or pass on the properties in the future. Companies pay tax at a rate of 25 on rental profits.

But before making this decision you must look at the advantages and disadvantages property tax expert Kenny Logan provides the answers. The idea of buying residential property through a limited company was somewhat accelerated by buy-to-let landlords following punitive changes to the way in which they could account for mortgage interest. If any of the following also apply then a limited company becomes even more attractive.

If you live in the company apartment you would be charged income tax on the benefit of the provision of living accommodationIf the company were to sell the apartment it would be liable to pay corporation tax on the chargeable gain without either the main residence relief or the annual exemption of 10900. We would advise anyone that is thinking of incorporating a property portfolio into a limited company or buying the next property inside a limited company to book time with. Should I buy a property through my limited company as I hear that in certain circumstances it can be cheaper from a tax standpoint than purchasing it using my personal name.

Well perhaps senility is setting in at Monevator Towers but I dont see the case for acquiring a buy-to-let property through a limited company. If you are going to own the property as a long term investment then go for a limited company. If youd bought a property to flip as an individual your gains would be taxed as income which if youre taxed at the higher rate will be a whole lot more current rates here.

However that doesnt mean that its the. You intend to borrow money to purchase the properties. Over the last 10 years Ive learnt the reasons why you should move your property into a limited company and why not to have it in my personal name.

The properties must be sold at the market value which means some or all of the following additional costs. There are other options if you do not want to buy via your limited company. If you are a higher rate taxpayer renting out a property as a private individual you will pay up to 45 of your rental income in tax.

Acquiring properties can make a good form of investment for after tax profits retained in a company. Old property codgers and young influencers are united. If you buy a property as a higher or additional rate taxpayer you will have to pay income tax at 40-45.

Do so as a limited company and you will. Certainly you can do this but whether it is tax efficient is an important question to ask before you do. The short answer to the question is yes real estate investors can certainly buy an investment property through an LLC they create.

Whatever your personal situation is think carefully about whether the tax savings are worth it in the long run. Because when trading properties as a limited company you will pay corporation tax on your profits you can find the current rate here. Stamp Duty Land Tax at the higher rate will be payable on the purchase by the limited company even it is your first property purchase by the company.

These changes dictated that landlords were no longer permitted to offset their full mortgage interest against the profit of their buy-to-let. Their property tax specialist to ensure that tax will be saved by using a limited company structure. The short answer is Yes The longer answer is NO for a number of reasons including.

By The Investor on March 11 2021. Companies can also be used to purchase property. L ook into investing for rental income in the UK and youll invariably be told to purchase your buy-to-let property through a limited company.

A corporation can be used to buy a secondary property such as a vacation property but there are drawbacks. Most importantly you must personally pay the. If such profits were taken out of the company by the individual owners almost half of it would go in the payment of taxes.

If you are a business owner operating as a limited company you may have considered buying property through your business.

How To Legally Take Money Out Of A Limited Company Company Debt

How To Start A Real Estate Business In 2021 Fortunebuilders

5 Reasons You Need Use A Real Estate Management Company Real Estate Management Estate Management Property Management

Can You Get A Real Estate Investment Loan Under Your Llc Under 30 Wealth Real Estate Investing Rental Property Real Estate Investing Real Estate Rentals

Rules Of Thumb For Analyzing Real Estate Investments Under 30 Wealth Real Estate Buying Real Estate Real Estate Business Plan

Shop At Go Big Yellow Letter Investor Buying Houses Yellow Letter Lettering Real Estate Investor Mail Template

How To Do A Brrrr Strategy In Real Estate Real Wealth Network Real Estate Investing Rental Property Real Estate Education Real Estate Investing

How To Track And Manage Your Rental Properties Rental Property Investment Rental Property Management Real Estate Investing Rental Property

Holding Company Structure For Llcs

What Are The Documents Required For Setting Up A Private Limited Company In Singapore Find Here The A Private Limited Company Create A Company Limited Company

Real Estate Syndication A Doctor S Guide To Investing Debt Free Dr Getting Into Real Estate Investing Company Structure

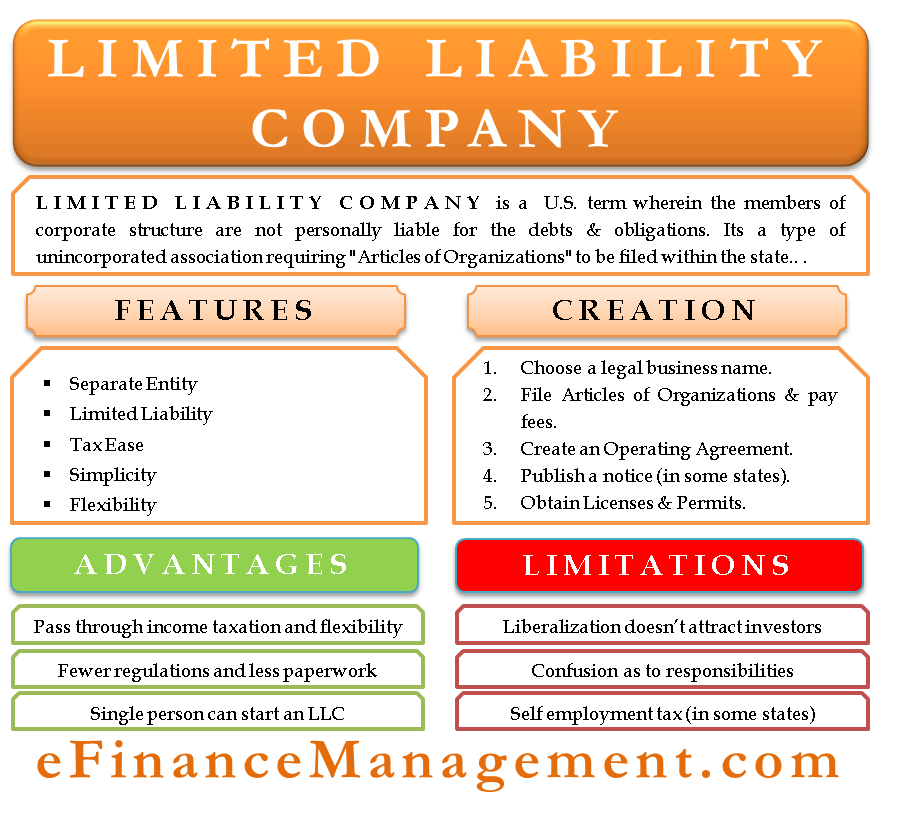

Limited Liability Company Meaning Features Pros Cons

Tenant Welcome Letter Ez Landlord Forms Being A Landlord Rental Property Management Property Management Marketing

Should I Own My Property In Llc Real Estate Investing Rental Property Rental Property Management Real Estate Rentals

The Land Is A Tricky Business Space There Can Be Shifted Motivations To Buy Or Sell A House The Name Real Estate Houses Things To Sell Selling Your House

Can You Buy A Rental Property Through An Llc Rental Property Buying A Rental Property Real Estate Buying

How To Start A Real Estate Business In 2021 Fortunebuilders

The Ultimate Guide To Wholesaling Real Estate Learn How To Buy Properties At A Discount By David Dodge Independently Published Wholesale Real Estate Real Estate Investing Wholesaling Buying Property

Post a Comment for "Can I Buy Property With My Limited Company"