Small Business Hazard Insurance For Sba Loan

Small Business SBA Hazard Loan Insurance Loan proceeds can finance existing or new improvements on a leasehold interest in land. - Adjustable to fit your needs - Lowest Rates Nationwide.

Business Owner S Policy Insurance Cost Insureon

The Small Business Administration SBA requires lenders to obtain hazard insurance on any real or personal property collateral securing a loan.

Small business hazard insurance for sba loan. For some survivors completing a low-interest disaster loan application may be crucial to their recovery. See how two owner-ops dealt with it here on Overdrive. All theyre making an attempt to do is to guard the mortgages collateral or on this case your corporation.

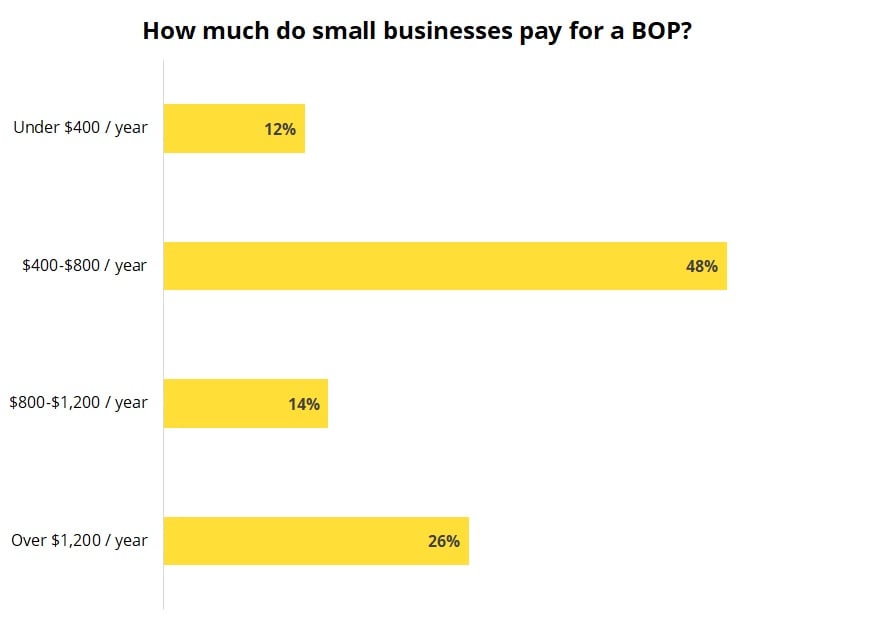

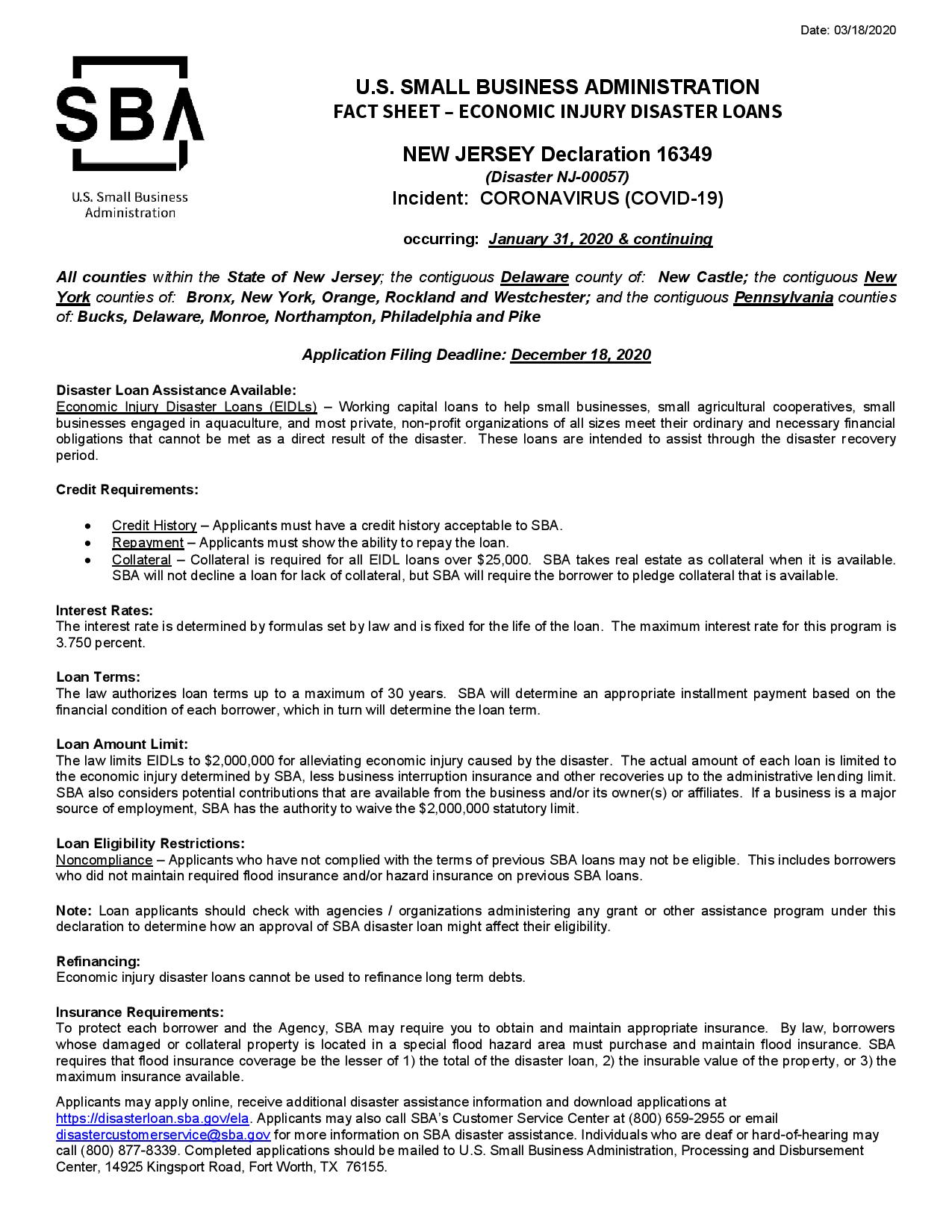

However we recommend you insure 100 of your business property value with hazard insurance because if you had a total-loss situation you would want to make sure you could replace all of your business property. Depending on the GL limit required it might be more affordable to purchase a BOP or Standard package policy with lower limits and add an Umbrella Liability Insurance policy to raise the limits on your General Liability Insurance. EIDL loans require debtors to acquire hazard insurance coverage inside 12 months of getting accepted.

Next to insurance an SBA low-interest disaster loan is the primary source of funds for. While almost all our clients accepted the PPP Loan and EIDL Advance a small percentage took the EIDL Loan too. This guide accompanies the Insurance for a Small Business PowerPoint Presentation.

Every SBA loan will require General Liability Insurance GL. Within 12 months from the date of this Loan Authorization and Agreement the Borrower will provide proof of an active and in effect hazard insurance policy including fire lightning and extended coverage on all items used to secure this loan to at least 80 of the insurable value. As well as you should preserve that protection all through the lifetime of the mortgage.

In the case of EIDL the SBA requires the borrower maintain hazard insurance to protect collateral. Sba small business loans are intended to help small business owners overcome the negative effects of the coronavirus pandemic so if youve struggled to an sba disaster loan can be used to repair or replace real estate personal property machinery and equipment and inventory and business assets. Sba disaster assistance loans faq sheet.

Rates As Low As 50month - Instant Evidence of Insurance. Its essential that various require-ments for the insurance policy be vetted and communicated to all the lines of business that originate commercial real estate loans. Hazard Insurance for an SBA Loan The ongoing COVID-19 pandemic has affected millions of small businesses in the US.

During the spring the SBA offered practice owners an Economic Injury and Disaster Loan of up to 150k in addition to the PPP Loan of 25 times eligible monthly payroll costs and the EIDL Advance of 1k per employee up to 10k. For this reason the Small Business. Hazard Insurance Requirements To properly protect real property collateral securing commercial loan transactions a bank must define its hazardproperty insurance re-quirements.

In order to obtain an SBA loan small business owners must be in full compliance with state requirements. Wildfire survivors in Oregon who apply for assistance with FEMA may also apply with the US. SBA notices should not be cause for concern CALL 424 888-7635 now to get a FREE quote purchase your insurance print your certificate rest easy the same day.

Insurance for a Small Business Participant Guide Money Smart for a Small Business Curriculum Page 3 of 18 Welcome Welcome to the Insurance for a Small Business training. Just like any other lender the SBA is trying to protect their loans collateral from unforeseen circumstances. Small Business Administration SBA for a low-interest disaster loan.

By taking this training you are taking an important step to building a better business. The good news is that General Liability can be found in every BOP or Standard Package policy. Therefore the underlying ground lease must include at a minimum detailed clauses addressing Lenders or assignees right to hazard insurance proceeds resulting from damage to improvements.

Currently the SBA is requiring that your hazard insurance is at least 80 of your loan amount. This type of insurance provides wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employees right to sue for negligence. SBA Required Hazard Insurance.

DR-4562-OR NR 21. The Small Business Administration SBA offers an economic injury disaster loan EIDL to provide relief to small businesses that experienced a. SBA Loan Insurance A Small Business Administration Loan will require you to purchase Hazard Insurance equal to or up to 80 of your loan amount.

If you took out an SBA disaster loan last spring you may have recently been asked to verify insurance. Our experienced office is ready to provide you the right coverage at the best price.

Hottest Small Business Insurance Trends For All Owners

Business Insurance For Record Labels How To Start An Llc

Insurance Requirements For Sba Loans The Bunker Vault

Insurance Requirements And Consideration For Sba Loans

How Much Does Business Insurance Cost Business Insurance Small Business Insurance Insurance

Disaster Covid 19 Business Lending Grants State Federal 21 501 Vermont Small Business Development Center

6 Cheapest General Liability Insurance Companies For Small Business

Life Insurance For Sba Loans Why It S Required In 2021

Life Insurance For Sba Loans Why It S Required In 2021

Cheap Business Insurance In 4 Easy Steps Insureon

Loans For Small Business Begin To Flow Wsiu

Applying For Sba Eidl Disaster Assistance

Sba Economic Disaster Injury Loans Now Available For Small Businesses In Nj Affected By The Coronavirus Covid 19 Essex County Small Business Development Affirmative Action

Us Small Business Administration Covid 19 Assistance

Covid 19 Relief Loans For Small Businesses Masstlc

110 What Can I Use The Eidl Loan For Youtube Loan I Can Hazard Insurance

Sba Loans And Life Insurance Life Insurance For Small Businesses

Eidl Loans Require Hazard Insurance Here S How To Get It Surfky Com

Risks Associated With Ppp Loans An Insurance Solution Total Food Service

Post a Comment for "Small Business Hazard Insurance For Sba Loan"