Business Use Of Home Direct Vs Indirect Expenses

Theyll exist even if youre not manufacturing a product. Examples of indirect expenses generally include insurance utilities.

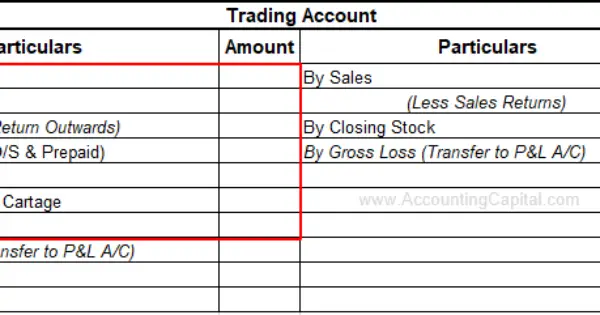

Direct And Indirect Expenses With Examples Accountingcapital

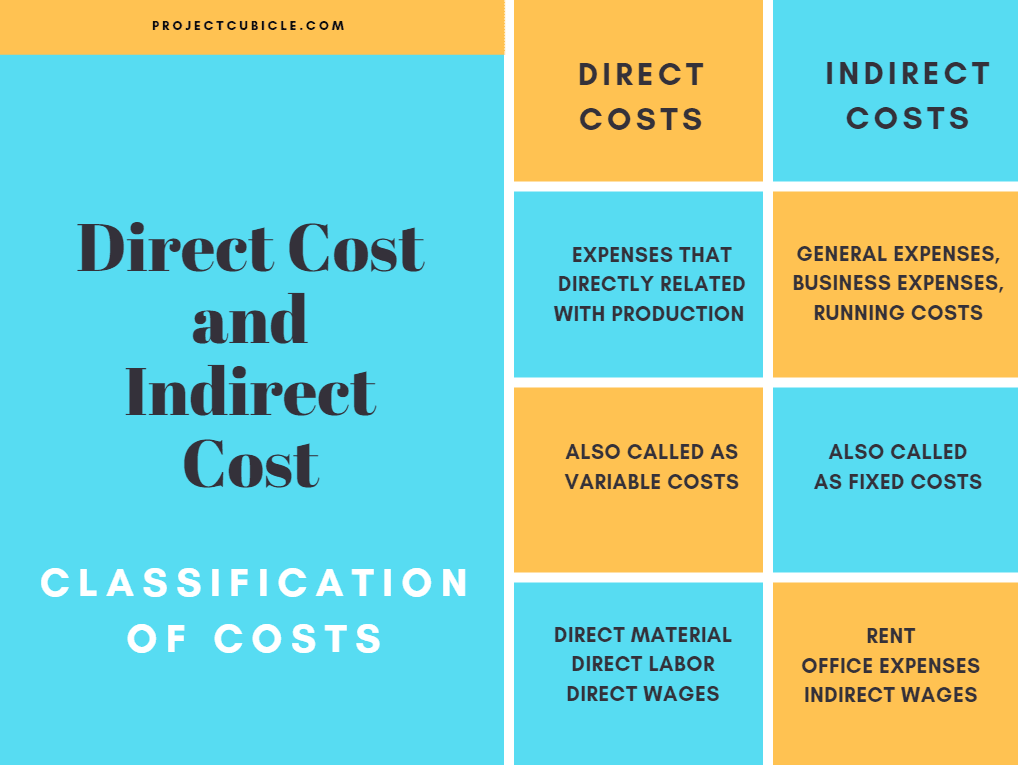

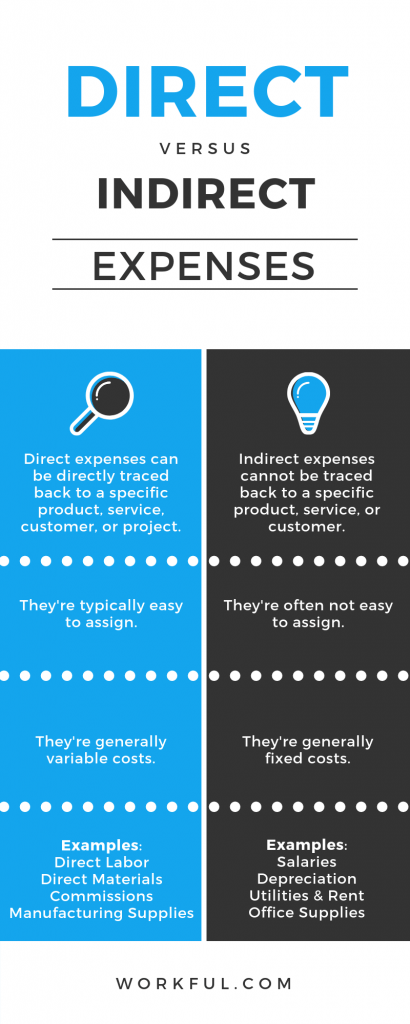

Unlike direct costs you cannot assign indirect expenses to specific cost objects.

Business use of home direct vs indirect expenses. Direct Expenses are outrightly allocable to the particular cost object or cost unit. Indirect costs are expenses that apply to more than one business activity. For example if the electric bill is 200 enter 200 for each business occupying the home.

Direct expenses are those made specifically to the home office used for business and not made to the rest of the home. Direct expenses can be traced to a specific product service customer or project. An example of this is your electricity bill.

If you select Home the fields in the Business use of a home and Allowable deductions group boxes become available. Indirect expenses are those made to the whole home and not only specific to the home office. Indirect costs are not.

You deduct 100 of these expenses. Select the home office asset type from the drop-down list and press TAB. Indirect costs more frequently have to.

These are expenses that directly affect only the part of your home used for your business. Direct costs are linked specifically to a cost object such as an item or service. Indirect Expenses are those expenses that are paid for keeping up and running your entire home.

If you select Improvements the field in the Improvements group box becomes availableIf you have entered two home offices mark the appropriate Home office option to distinguish whether the asset belongs. Direct expenses are those expenses that are paid only for the business part of your home. Indirect expenses cannot be directly traced back to a specific product service customer or project.

Employee salaries eg administrative Professional expenses. You and your family probably live in the same rooms where you provide your daycare services so the amount you can deduct depends on the amount of time you use those areas for business only. You may deduct direct business expenses in full and may allocate the indirect total expenses of the home to the percentage of the home floor space used for business.

For multiple businesses in one home make an entry in Percentage xx of indirect expenses and business use area to apply to this business if not 100. For example if you pay for painting or repairs only in the area used for business this would be a direct expense. Important notes regarding Direct and Indirect Expenses.

Mortgage interest and real estate taxes input in the direct expenses section will be allowed in full for the home. Here are some of the key differences between direct and indirect costs. For example if you pay for painting or repairs only in the area used for business this would be a direct expense.

A qualified daycare provider who doesnt use his or her home exclusively for business purposes however must figure the percentage based on the amount of time the applicable portion of the home is used for business. Examples of indirect costs include. Direct expenses are completely related and assigned to the core business operations of a company whereas indirect expenses are not directly related.

When you use the standard method you can deduct the time percent of your direct expenses and your time-space percent of the indirect expenses. For direct expenses enter only the amount of expenses that are allowable for that specific business as any direct expense will carry directly to the form and be allowed in full. For example repairs done in your office or having it painted.

Indirect Expenses are those expenses that are paid for keeping up and running your entire home. These are 100 deductible expenses. Direct costs must also be tied to a specific.

For example installing a light fixture or painting that room only An indirect expense benefits your entire home not just your home office. Theyre used to determine pricing. A direct expense is something that will only benefit the business section of your home.

Painting and decorating the office. Maintenance and repairs. Indirect Expenses When Computing the Home Office Deduction.

The installation of a ceiling fan in a home office or built-in cabinet in a home office are both examples of direct expenses incurred for the home office. As against Indirect Expenses are incurred in connection to the day to day business operations. Hiring or furnishing maid service for the office.

For accounting purposes direct costs are always factored into your cost of goods sold while indirect costs are recorded as an overhead expense. ProConnect Tax Online will use this information in conjunction with square footage to allocate indirect expenses. Direct Expenses are those expenses that are paid only for the business part of your home.

Direct Expenses are the expenses which are incurred in the manufacture of a product or provision of services. If the expense is indirect use the business percentage of these expenses to figure how much to include in your total business-use-of-the-home deduction. Direct and Indirect Expenses Expenses are amounts paid for goods or services purchased.

For indirect expenses enter the full amount of the expense for each home office. In order to do so enter the indirect expenses in full for each of the home offices on each screen. Examples of Direct deduct 100.

Certain expenses are deductible to the extent they would have been deductible as an itemized deduction on your Schedule A or if claiming the standard deduction would have increased your standard deduction had you not used your home for business. Direct costs typically relate to production.

Product And Period Costs Double Entry Bookkeeping

Direct And Indirect Costs Of College

Direct Vs Indirect Costs Directions Cost Business Expense

Direct Indirect Expenses Definition Examples Video Lesson Transcript Study Com

What Are Some Examples Of Direct Indirect Expenses Workful

Direct Costs And Indirect Costs Cost Classification Projectcubicle

Direct Cost Vs Indirect Cost Direct Costs And Indirect Costs Are Both Important But If We Look Inherently We Will See That There Directions Cost Sheet Cost

Direct Expenses Vs Indirect Expenses Workful

Direct And Indirect Expenses With Examples Accountingcapital

Direct Vs Indirect Costs In The Construction Industry Lutz Accounting

Direct Indirect Labor Overhead Costing In Budgeting And Reporting Income Statement Financial Statement Directions

Difference Between Direct And Indirect Expenses With Examples And Comparison Chart Key Differences

Direct And Indirect Expenses With Examples Accountingcapital

Direct Indirect Labor Overhead Costing In Budgeting And Reporting

What Are Some Examples Of Direct Indirect Expenses Workful

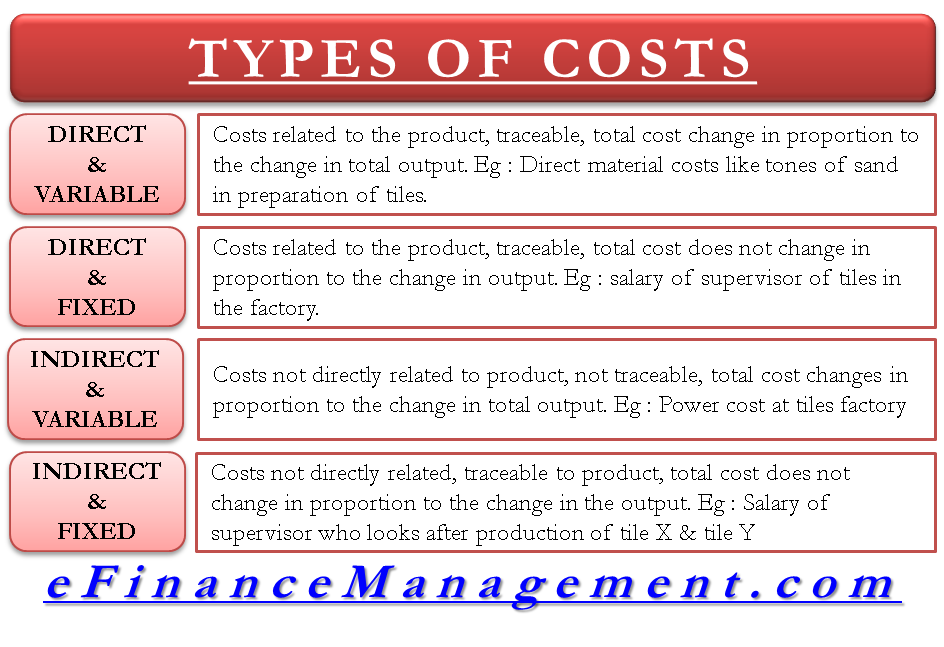

Types Of Costs Direct Indirect Costs Fixed Variable Costs Efm

Annual Profit Loss Free Office Form Template Document Sample Profit And Loss Statement Statement Template Income Statement

Schedule C Guide Part Ii Expenses Bookkeeping Software Schedule Business Notes

Post a Comment for "Business Use Of Home Direct Vs Indirect Expenses"