Small Business Taxes Kansas

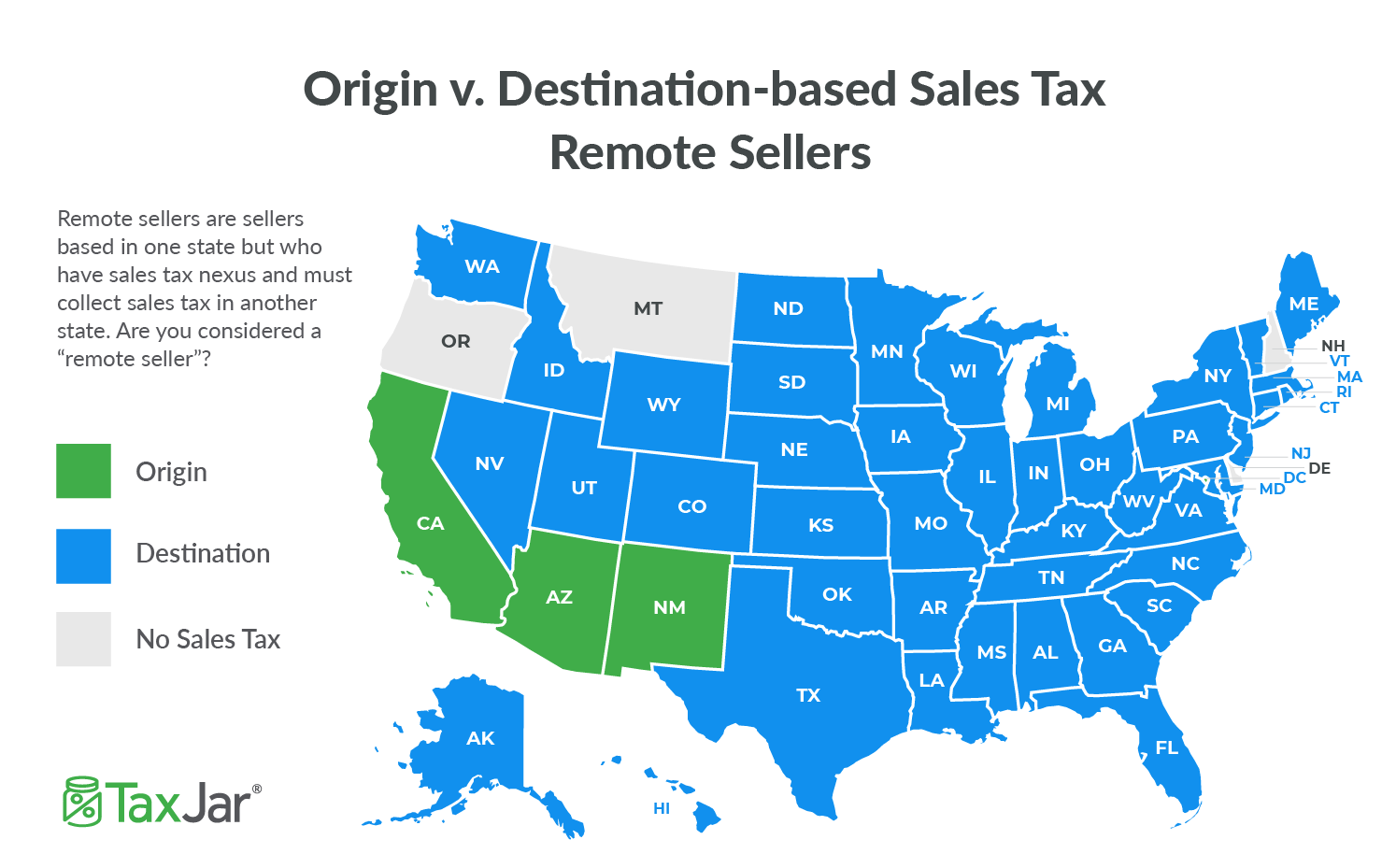

Our full time advisors and Kansas City accountants have a range of industry and. Sellers based out-of-state also charge sales tax based on the destination of the buyer.

Small Business Tax Rates For 2020 S Corp C Corp Llc

The Business Tax Application allows for the registration of several licenses such as sales tax withholding tax.

Small business taxes kansas. We understand that running your business is a full time job and understanding the myriad of tax law and compliance can be headache. Similar to the personal income tax businesses must file a yearly tax return and are allowed deductions such. In addition you can call or email a Taxpayer Assistance Center representative for general information.

The state of Kansas does not register sole proprietorships dba assumed name trade name or fictitious name entities. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business. You live and run your business in Topeka KS 66409 which has a sales tax rate of 73.

The Kansas Department of Revenue has three Taxpayer Assistance Centers to help residents and businesses answer tax questions or file taxes. To register for and pay your business taxes you will need to set up an account with the Kansas Department of Revenue Customer Service Center. The bill targets relief to relatively small businesses.

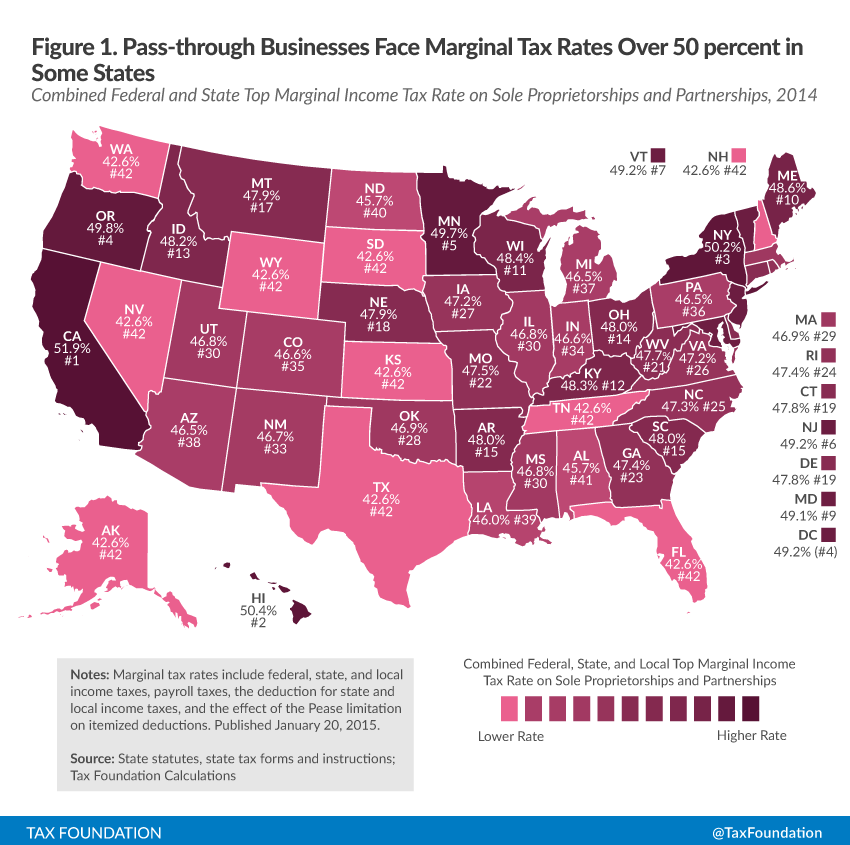

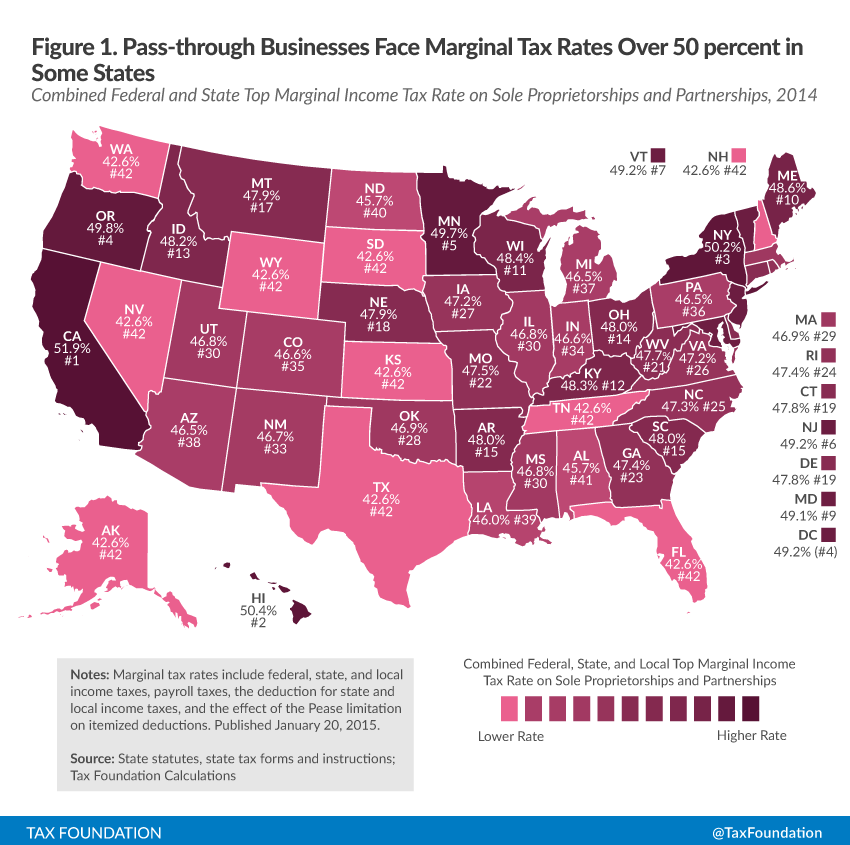

2 A small business owner with income this high whose company is a. You would collect at the 877 rate. The are located in Topeka Overland Park and Wichita.

The Kansas corporate income tax is the business equivalent of the Kansas personal income tax and is based on a bracketed tax system. The federal level shareholders income or loss which is included in their individual federal income tax returns is to be subtracted from federal. Listed below are tax topics of interest to businesses.

Successful Small Business Owners in Kansas City. The 2021 tax tables show that the top federals income tax rate is 37 on 523601 of taxable income for individuals and heads of households and 628301 for married individuals filing jointly. Those entities are required to file a privilege tax return to report any income or loss.

A Kansas business may be liable for the collection andor payment of a variety of taxes. TrademarkService-Mark Search view information for a TrademarkService-Mark on file with the Secretary of State. In addition net income in excess of 50000 is subject to a 3 percent surtax.

The Kansas Business Filing Center offers access to the Kansas Secretary of States online business services through KanAccess. The KanAccess sign-on enables businesses to submit filings online and access their records with the Secretary of State. You can do so by clicking the Customer Service Center link at.

Only those with 2019 income between 10000 and 25 million could get a refund. The elimination of Kansas income tax on profits for owners in limited liability companies or LLCs subchapter S corporations and sole. Banks and saving and loan associations allowed to file as a small business corporation at the federal level are not allowed to file as a small business corporation at the Kansas level.

The information on this page is not intended as a substitute for the law but provides information and links to other resources about taxes that may be required to be paid by your business. These topics provide a brief description of the tax and offer links to other information on forms publications rates electronic services or frequently asked questions. For corporations whose business income is solely within state boundaries the tax is 4 of net income.

Over the last 20 years TaxesPlus has been designed to be a strategic financial partner for the small business owner. Name Availability check to see if a business name is available. Kansas corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in Kansas.

Business Tax Application Businesses will need to register for a Business Tax License with the Kansas Department of Revenue. Congratulations on starting your new Kansas business. Business Licenses The state of Kansas doesnt have a general business license.

The Kansas Department of Revenue offers periodic Sales Tax workshops conducted at various locations across the state. Small Business Administration - Kansas. This workshop explains the difference between Kansas Retailers Sales tax Kansas Retailers Compensating Use tax and Kansas Consumers Compensating Use tax.

Area small-business owners are certain of one thing. Visit the Kansas Business One Stop for more information about planning. However many cities require a business license in order to operate.

You sell to a customer in Kansas City KS which has a sales tax rate of 877. Charitable Organizations view information on registered charities in Kansas.

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Where S My Refund Kansas H R Block

Kansas Department Of Revenue Business Tax Home Page

How To Get A Resale Exemption Certificate In Kansas Startingyourbusiness Com

.png)

States Sales Taxes On Software Tax Foundation

Kansas Department Of Revenue Business Tax Home Page

Small Businesses And Their Income Tax Burden Tax Foundation

Kansas Department Of Revenue Aaddinfo Letter Sample 1

Https Www Ksrevenue Org Pdf Kw100 Pdf

Kansas Department Of Revenue Business Tax Home Page

Origin Based And Destination Based Sales Tax Collection 101 Taxjar Blog

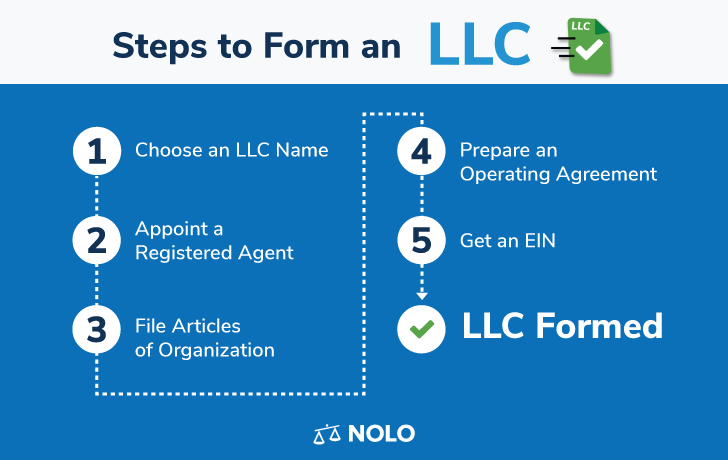

Kansas Llc Steps To Start A Kansas Llc Nolo

Kansas Department Of Revenue Business Tax Registration And Business Closure

Kansas Income Tax Calculator Smartasset

Kansas Department Of Revenue Business Tax Home Page

Business Center One Stop Kansas One Stop Business Information

Https Ksrevenue Org Pdf Pub1510 Pdf

Post a Comment for "Small Business Taxes Kansas"