What Is My Business State Tax Id Number

Minnesota Department of Revenue. Your EIN identifies your business as an operational entity that pays taxes to the IRS.

If you are from one of these states and you also want to get a federal Employer Identification Number EIN you may obtain both your state and federal information in one session.

What is my business state tax id number. A state employer identification number also called an EIN is an identification number businesses need to collect and pay state income tax. Most businesses need a Minnesota tax identification number. The primary purpose of an EIN is to identify a companys income tax and employment tax returns.

Sales and Use Tax. Is used for all payroll tax programs. Most states use the federal nine-digit EIN number for tax purposes so that is often the number you need.

Income Tax Return for Estates and Trusts. An EIN is a form of business identification similar to how a Social Security number serves as a personal form of identification. Choose and enter only one form of ID verification.

You need it to pay federal taxes hire employees open a bank account and apply for business licenses and permits. The EIN is used many times when filling out your annual tax forms. If you need one you can apply through Business Tax Registration.

A Minnesota Tax ID Number is a seven-digit number used to report and pay Minnesota business taxes. You will leave the IRS website and enter the state website. If the owners of your business changes you must notify the Department to update your account information.

Numerous callers each year contact this Department inquiring about a Tax ID Number and what agency specifically issues it. Owners of most types of. The Minnesota Department of Revenue manages the state.

State Tax ID Systems State tax ID numbers are issued by the department of revenue or similar agency in the state where the business is. An Employer Identification Number EIN is also known as a federal tax identification number and is used to identify a business entity. Alternatively your state tax ID number is only useful for filing state taxes.

A Tax Id number is also called an Employer Identification Number or EIN. Often the reason why people need the identification number is because they have been advised by a bank that no account will be opened without it even if it is requested by a non. If you need a business registration number from one of the states listed on this page all you need to do is click on one of the links below.

Common mistakes made when registering a business with the Department - Applying for a tax number after starting a business. State Taxpayer ID - TID Located on Liability Notice Social Security Number - SSN. Its free to apply for an EIN and you should do it right after you register your business.

A business needs to obtain a Minnesota tax identification number a seven digit number assigned by the Minnesota Department of Revenue if it is required to file information returns for income tax purposes has employees makes taxable sales or owes use tax on its purchases. However the Business Registry. Revenue Minnesota Department of.

Withholding unemployment tax Workers Benefit Fund Assessment and transit taxes TriMet and Lane Transit. Enter Primary Zip Code. If you are doing business with a company you may need to have its state tax ID number.

A Minnesota Tax ID Number is a seven-digit number used to report and pay Minnesota business taxes. The Tax ID number is actually called a Federal EIN Federal Employer Identification Number. Zip Code or 6 digit Canadian Postal code.

You can find a tax ID number online on specific forms and documents or by contacting the appropriate department within the company. A business tax ID number also called an employer identification number EIN or federal tax ID is a unique nine-digit number that identifies your business with the IRS. Is not the same as your Business Registry Number obtained through the Secretary of States Business Registry.

You must register with the Department prior to operating your business. It is also used by estates and trusts which have income which is required to be reported on Form 1041 US. Your Employer Identification Number EIN is your federal tax ID.

This number has nine digits and is used for determining and tracking your business federal tax obligations. Minnesota Tax ID Requirements Minnesota Department of Revenue. Refer to Employer ID Numbers for more information.

EIN is nationally recognized and can be used to identify a company in any part of the country. Enter one ID and primary customer zip code to retrieve your Case ID. Only businesses that operate in states that do not collect personal income tax and sole proprietors that choose to use their Social Security number in place of a state EIN are exempt from holding a state EIN.

Get a Federal and State Tax Id Number.

Pin By Kita On Finance Credit Employer Identification Number Social Media Site Business Website

Pin By Lance Burton On Unlock Payroll Template Tax Refund Money Template

Fake Bank Statement 2 2 Unconventional Knowledge About Fake Bank Statement 2 That You Can T Confirmation Letter Doctors Note Template Letter Of Employment

4 Form Deductions 4 Benefits Of 4 Form Deductions That May Change Your Perspective 1099 Form Deductions Handy Printabl Tax Prep Checklist Business Tax Tax Prep

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Inform Irs Forms Irs Tax Forms

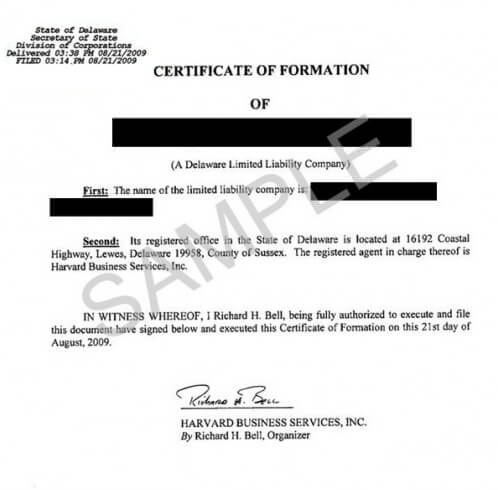

Delaware State File Number What It Is How It S Used Harvard Business Services

Florida Sales Tax Login Ritx Fl Sales Bswa Net Revenue Sales Tax State Of Florida Tax

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms W2 Forms Income Tax

Business Registration Application For Income Tax Withholding Sales And Use Tax And Machinery Equipment And Manufacturing Income Tax Registration Tax Forms

Letter Ein Confirmation Confirmation Letter Employer Identification Number Doctors Note Template

Your State Tax Id And Federal Tax Id Numbers Also Known As An Employer Identification Business Finance Writing A Business Plan Small Business Administration

How Do I Obtain A Federal Tax Id When Forming An Llc Legalzoom Com

Where Do I Find My Employer Id Number Ein Turbotax Support Video Youtube

Tax Return Fake Tax Return Income Tax Return Income Statement

The Guide To A Painless Tax Season Nurse Ceo Tax Season Tax Prep Business Tax

Pin On Difference Betweem Single And Multi Member Llc

Is My Tax Id The Same As My Social

Register For A Sales Tax Permit In The State Of Virginia Business Solutions Virginia Sales Tax

Free Online Receipt Maker Fake Business License Fake Receipt Us Receipt Maker Receipt Bill Template

Post a Comment for "What Is My Business State Tax Id Number"