How To Find A Business With A Tax Id Number

Employee Common-Law Employee Employees. See the Minnesota Department of Revenue Minnesota Sales and Use Tax Business Guide.

The Guide To A Painless Tax Season Nurse Ceo Tax Season Tax Prep Business Tax

As an individual without a SSN.

How to find a business with a tax id number. 5 Click on the provider name for additional information. One of the easiest ways to obtain a companys Federal Tax ID or Employer Identification Number is to simply call the business and ask for it. If your EIN has changed recently which could render any old documents useless you should definitely call the IRS.

Keep in mind though that such services usually charge a fee for each search. You will leave the IRS website and enter the state website. The specifics of your TIN as an entity should be reviewed with a legal advisor.

2 Enter your Criteria. 3 Select the State in which you would like to search. Second check your prior tax returns loan applications permits or.

Generally businesses need an EIN. You can find the number on the top right corner of your business tax return. If all else fails and you really cannot find your EIN on existing documents you can reach out to the IRS by calling the Business Specialty Tax Line at 800-829-4933.

If you need to locate another companys EIN you can start by asking the company. First check to see if you received an email or physical letter from the IRS confirming your EIN when you first applied. 1 Choose a Search Type.

According to the IRS a federal tax ID number is used to identify a businessThere are many reasons why a business may need one including paying employees. You may apply for a Minnesota Tax ID number with the Minnesota Department of Revenue online at Business Registration by phone at 651-282-5225 or 800-657-3605 or by filing a paper form Application for Business Registration ABR. Your nine-digit federal tax ID becomes available immediately upon verification.

This information is public record and theres really no reason that a business shouldnt be willing to give theirs out when asked. An Employer Identification Number EIN is also known as a federal tax identification number and is used to identify a business entity. Any other tax documents the business.

If you are from one of these states and you also want to get a federal Employer Identification Number EIN you may obtain both your state and federal information in one session. E-file Form 940 941 or 944 for Small Businesses. It will be in either your email or in a letter depending on how you applied.

This is a free service offered by the Internal Revenue Service and you can get your EIN immediately. If you need a business registration number from one of the states listed on this page all you need to do is click on one of the links below. Look at the business tax records.

However an entity with the legal structure of an S-corp corporations for example may have the TIN may be that of the owner. You may apply for an EIN in various ways and now you may apply online. It is also used by estates and trusts which have income which is required to be reported on Form 1041 US.

You can also call the IRS to look up your federal tax ID number. Every W-2 a business sends to its employees lists its employer identification number EIN. Make sure to call between the hours 7 am.

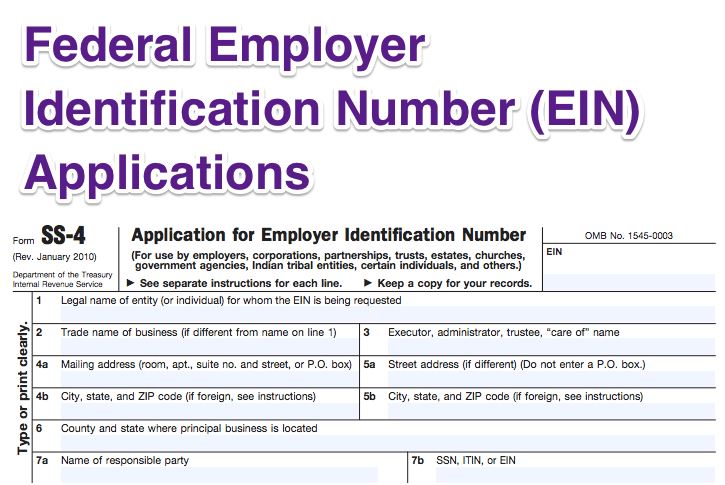

Works with certain types of organizations. Employer ID Numbers EINSS-4 Employers Tax Guide Circular E Employment Eligibility Verification. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

Find tax information and tools for businesses including Employer ID Number EIN Employment Tax Estimated Tax and the Foreign Account Tax Compliance Act FATCA. Getting a federal tax identification ID number is an important first step when you start your business. It will guide you through questions and ask for your name social security number address and your Doing Business As DBA name.

Refer to Employer ID Numbers for more information. If you open the return and discover that the number has been replaced with asterisks for. Apply for an EIN with the IRS assistance tool.

If you have a businesss tax ID number but dont know the name of the business and plugging the number into an Internet search engine doesnt get you the businesss name you may be able find out by using a reverse look-up service such as Search Bug. As an entity. Your TIN is most likely the business entitys Employer Identification Number EIN.

Employees of Foreign Governments or International Organizations. Income Tax Return for Estates and Trusts. Find a W-2 from any year and look in box b near the top left corner of the page.

Taxpayer Identification Number How To Apply Are You The One Social Security Card

Obtaining Taxpayer Identification Number Tax Id In Ukraine From 99 Usd Corporate Law Tax Law Firm

Pin By Lance Burton On Unlock Payroll Template Tax Refund Money Template

Form Ss4 And Everything You Need To Know Ss4 Online Photography Business Photography Learning Photography

What Exactly Is Your Tax Id Number Learn The Difference Between An Ein And Your Sales Tax Id And Wheth Sales Tax Business Ideas Entrepreneur Learning Numbers

Fake Bank Statement 2 2 Unconventional Knowledge About Fake Bank Statement 2 That You Can T Confirmation Letter Doctors Note Template Letter Of Employment

Pin By A Web To Know On Law Federal Taxes Employer Identification Number How To Apply

Tax Return Fake Tax Return Income Tax Return Income Statement

How To Know Your Lost Tax Identification Number In The Philippines How To Know Knowing You Us Tax

How To Find Your Lost Misplaced Ein Make Your Ein Application Online Finding Yourself Confirmation Letter Online Application

What Is Irs Schedule C Business Profit Loss Irs Tax Forms Irs Taxes Tax Forms

Letter Ein Confirmation Confirmation Letter Employer Identification Number Doctors Note Template

How To Apply For An Ein Employer Identification Number For Your Business Taxes Wahm Business Tax Small Business Finance Employer Identification Number

Tax Forms Directory Comprehensive Irs Tax Forms Guide Irs Taxes Irs Tax Forms Business Tax Deductions

What S A Tax Id Number Employer Identification Number How To Apply Tax

What Is An Employer Identification Number Blogger S Beat Employer Identification Number Business Blog Business Insurance

What Is An Fein Federal Ein Fein Number Guide Business Help Center

Pin By Monica Heflin On Blogging Federal Taxes Small Business Law Blog Taxes

Post a Comment for "How To Find A Business With A Tax Id Number"