Small Business Gross Receipts Test

The term gross receipts is defined under Temp. This test is met if a taxpayer has average annual gross receipts for the three prior taxable years of 25 million or less adjusted for inflation.

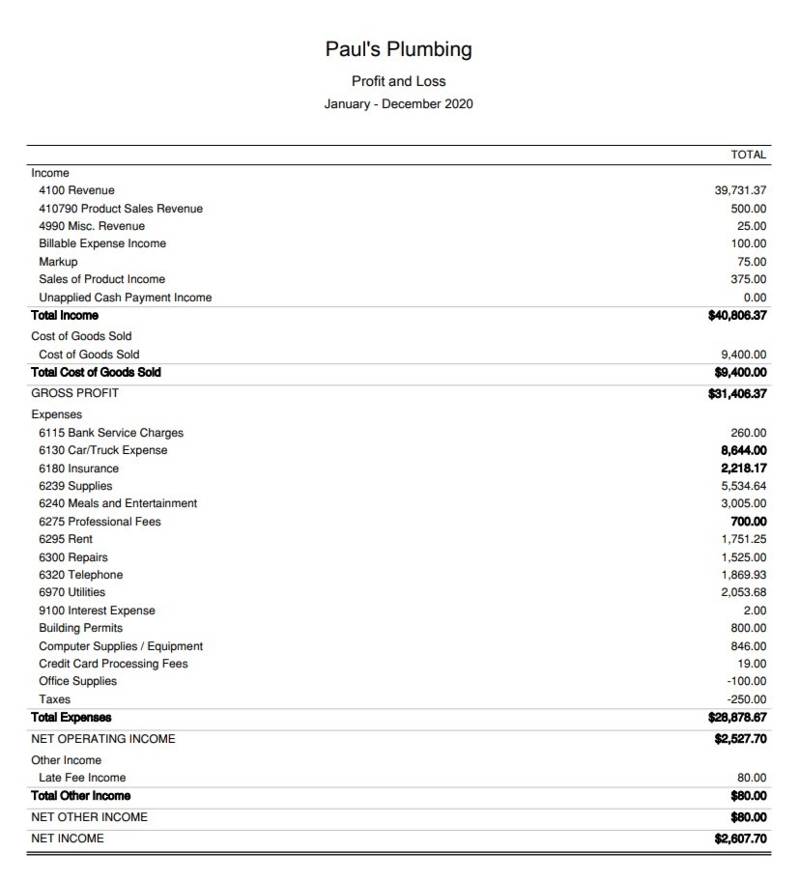

Small Business Tax Spreadsheet Business Tax Deductions Business Worksheet Business Budget Template

25 million gross receipts test For tax years beginning after December 31 2017 the tax breaks that follow can be claimed by a business that meets a gross receipts test This test requires having average annual gross receipts in the three prior years not exceeding 25 million.

Small business gross receipts test. Small business taxpayers are those taxpayers other than a tax shelter that meet the gross receipts test in Section 448 c. The 25 million gross receipts test is contained in Section 448 c and is incorporated by reference into sections 263A 460 and 471. Gross receipts for a tax year of less than 12 months eg due to a change in accounting period or for an initial year are annualized by multiplying the gross receipts for the short period by 12.

For tax years beginning in 2019 and 2020 these simplified tax accounting rules apply for taxpayers with inflation-adjusted average annual gross receipts of 26 million or less known as the gross receipts test. A pass-through entity that is a small business taxpayer does not allocate excess taxable income excess business interest income or excess business interest to its owners. IRC Section 448c permits small businesses to use the cash method of accounting the small-business exception if their annual average gross receipts fall at or below a certain amount for the three-year period ending immediately before the current tax year the gross-receipts test.

Proposed regulations REG-132766-18 issued Thursday update various tax accounting regulations to adopt the simplified tax accounting rules for small businesses enacted by the law known as the Tax Cuts and Jobs Act TCJA PL. For example if a taxpayer. A taxpayer meets the gross receipts test if the taxpayer has average annual gross receipts of 26 million or less for the 3 prior tax years.

The TCJA broadened the small-business exception by increasing IRC Section 448cs gross-receipts-test amount to 25 million or. 52 a 52 b 414 m or 414 o are treated as a single person for purposes of measuring gross receipts. There are three things to consider regarding gross receipts.

A tax shelter as defined in Section 448 may not. If a borrower has acquired an affiliate or been acquired as an affiliate during 2020 gross receipts includes the receipts of the acquired or acquiring concern. Gross receipts of a borrower with affiliates is calculated by adding the gross receipts of the business concern with the gross receipts of each affiliate.

Businesses related or under common control must aggregate their gross receipts. 448 - 1T f2iv and includes sales net of returns and allowances and all amounts received for services. The TCJA expanded the definition of small business by permitting a taxpayer other than a tax shelter to meet the test if the taxpayers average annual gross receipts for the three - tax - year period ending with the year preceding the current tax year does not.

Gross receipts for any taxable year of less than 12 months must be annualized by multiplying the gross receipts for the short period by 12 and dividing the result by the number of months in the short period. A corporation or partnership meets the gross receipts test of this subsection for any taxable year if the average annual gross receipts of such entity for the 3-taxable-year period ending with the taxable year which precedes such taxable year does not exceed 25000000. All persons treated as a single employer under Sec.

If a taxpayer is not considered a tax shelter it is eligible to be considered a small taxpayer if it meets the gross receipts test of Sec 448c. Thus the 25 million gross receipts test is determined by averaging a taxpayers gross receipts for the three prior taxable years. The TCJA increased section 448 cs gross receipts test ceiling to 25 million which allows taxpayers to grow and continue to use the cash method of.

Apply the business interest limitation 5 For a business to be eligible for small business taxpayer treatment the taxpayer must not be considered a tax shelter and cant have average annual gross receipts of greater than 25 million. References the existing gross receipts test under section 448c2 and increases the dollar threshold from 5 million to 25 million. The 25 million threshold is indexed for inflation and is currently 26 million.

Qualifying As A Small Business Corporation For Amt Purposes

Get Our Example Of Real Estate Marketing Budget Template For Free Cash Flow Statement Statement Template Budget Template

Is Your Company Profitable 5 Simple Steps To Check Your Numbers

Final Regulations On The Small Business Taxpayer Exception Crowe Llp

Bill Of Sale Receipt Receipt Template Bills Cash Credit Card

Step By Step Instructions To Fill Out Schedule C For 2020

Tax Template For Expenses Spreadsheet Template Business Spreadsheet Template Excel Spreadsheets Templates

Small Business Entrepreneurship Council

Instructions For Form 8990 05 2020 Internal Revenue Service

How To Prepare An Income Statement A Simple 10 Step Business Guide

Instructions For Form 8990 05 2020 Internal Revenue Service

Pro Forma Income Statement Example Elegant Free Downloadable Excel Pro Forma In E Statement For Statement Template Income Statement Financial Statement

Publication 583 01 2021 Starting A Business And Keeping Records Internal Revenue Service

Photography Accounting Spreadsheet Spreadsheets Contributed Us The Possible To Input Adjust

Instructions For Form 8990 05 2020 Internal Revenue Service

Get Our Image Of Profit And Loss Statement For Small Business Template For Free Statement Template Profit And Loss Statement Statement

The Crime And Passion Blog Profit And Loss Statements For Independent Publishers Profit And Loss Statement Small Business Accounting Statement Template

Irs Audit Letter 2205 A Sample 11

Post a Comment for "Small Business Gross Receipts Test"