Brookfield Business Partners K1

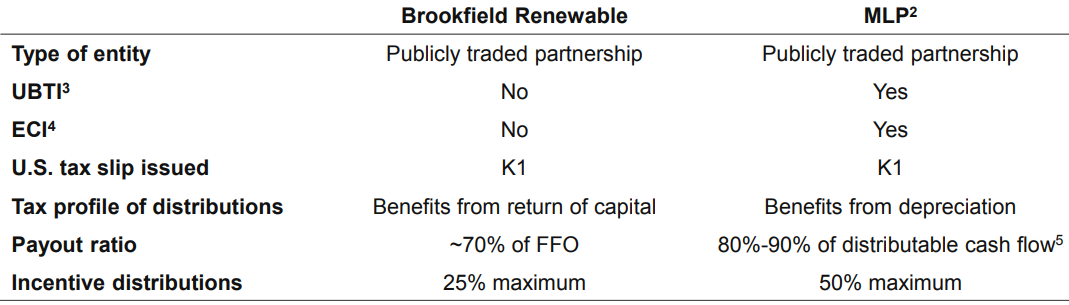

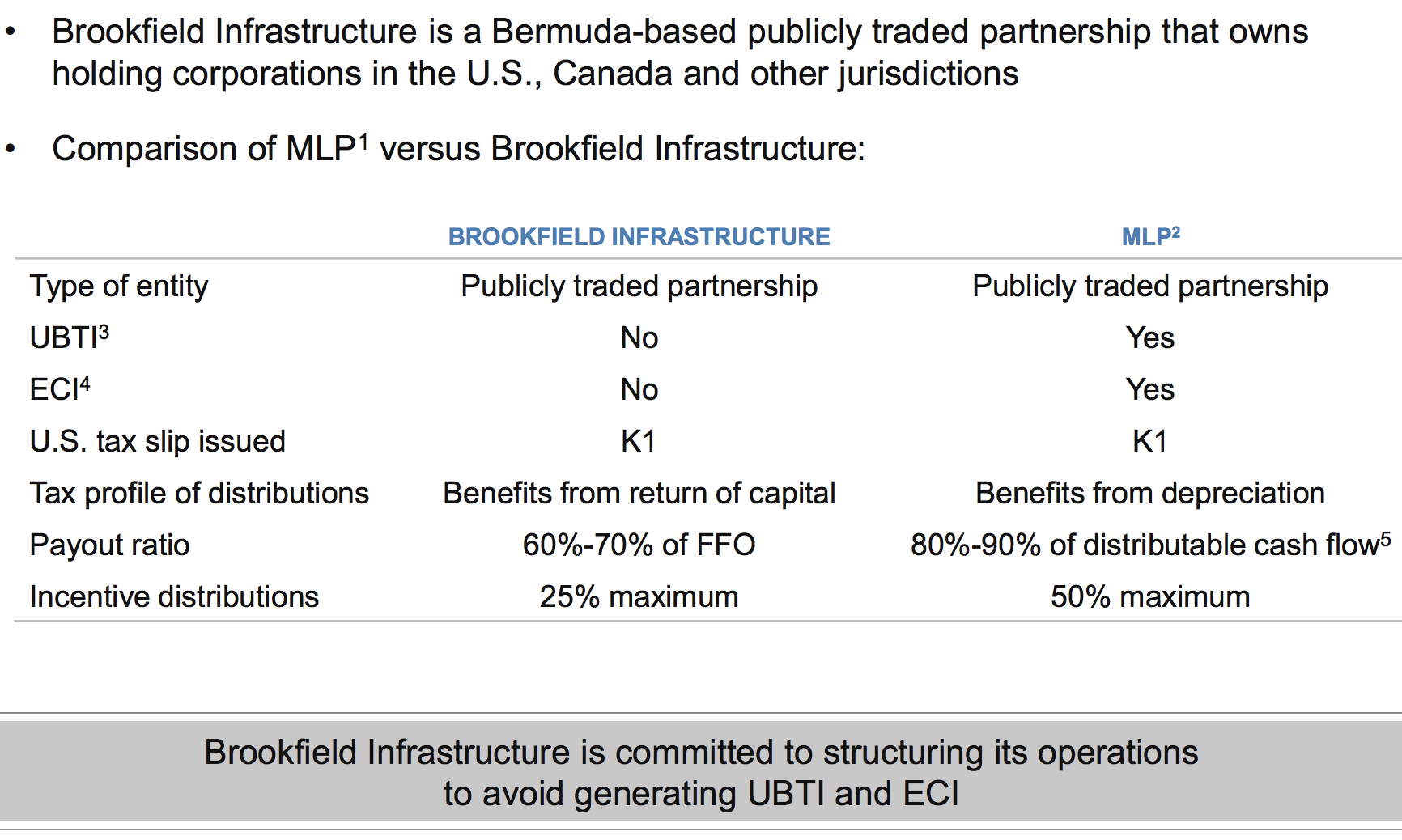

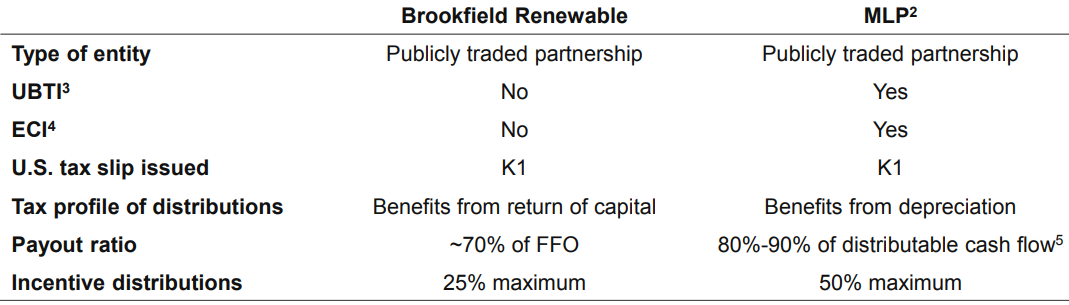

Brookfield Infrastructure Partners is required to use reasonable efforts to send a Schedule K-1 to all unitholders including those who may not require it. Receipt of a Schedule K-1 does not trigger a US.

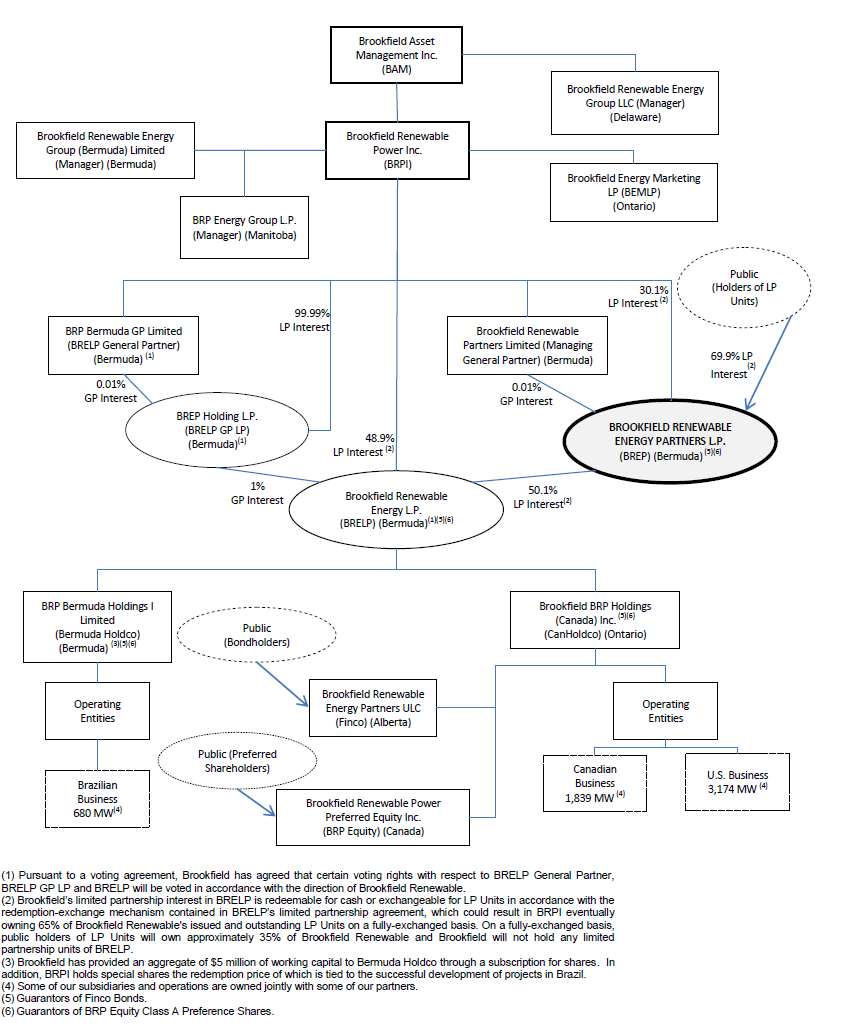

424b3 1 A2228664z424b3 Htm 424b3 Quicklinks Click Here To Rapidly Navigate Through This Document Prospectus Graphic Filed Pursuant To Rule 424 B 3 Registration No 333 207621 Brookfield Business Partners L P Limited Partnership Units

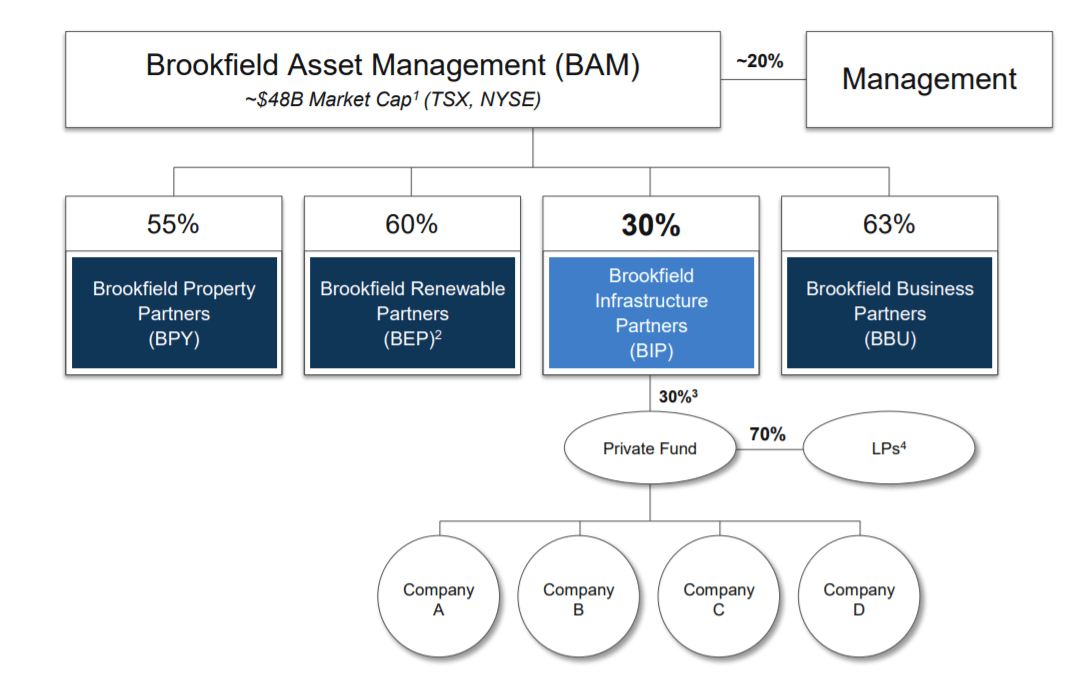

Brookfield Asset Management Inc.

Brookfield business partners k1. I received a K-1 from Brookfield Infrastructure Partners. The schedules distributed with Schedule K-1 compute the tax cost of Brookfield Renewable Partners units for US. Overview Brookfield Property Partners NASDAQ.

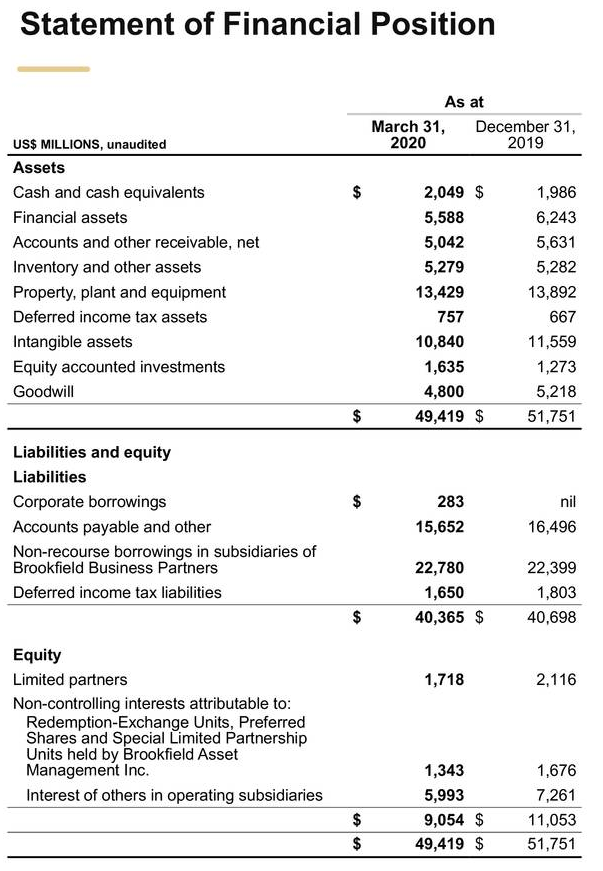

I am using Turbo Tax. Brookfield Asset Management is a leading global alternative asset manager with over 600 billion of assets under management across real estate infrastructure renewable power private equity and credit. Brookfield Business Partners 32 Table of Contents Our company structure involves complex provisions of US.

You have been logged out due to inactivity. To return to the application please click the button below. BPYUN BPY is a diversified global real estate company that owns operates and develops one of the largest portfolios of office retail multifamily industrial hospitality triple net lease student housing and manufactured housing assets.

Brookfield Infrastructure Partners LPs strategy is to acquire high-quality businesses on a value basis actively manage operations and opportunistically sell assets to reinvest capital into the business. You have been inactive for over 20 minutes. Youll fill out Schedule K-1 as part of your Partnership Tax Return Form 1065 which reports your partnerships total net.

The instructions simply say other ded. Overview Brookfield Renewable Partners operates one of the worlds largest publicly-traded renewable power platforms. You have been inactive for over 20 minutes.

The company has established a solid performance record delivering compounded annual total returns of 15 since its inception in 2008. The group seeks to engage inspire and support female employees at all levels through career growth and leadership development programs. 1 866 989 0311 N.

Brookfield Renewable Partners does not have sufficient information to track the tax cost of units for each individual holder. You have been logged out due to inactivity. The tax characterization of our company structure is also subject to potential legislative judicial or administrative change and differing.

Overview Brookfield Business Partners acquires high-quality businesses and applies its global investing and operational expertise to create value with a focus on profitability sustainable margins and sustainable cash flows. Monica Thakur Institutional IR Linda Northwood Retail IR Tel. To return to the application please click the button below.

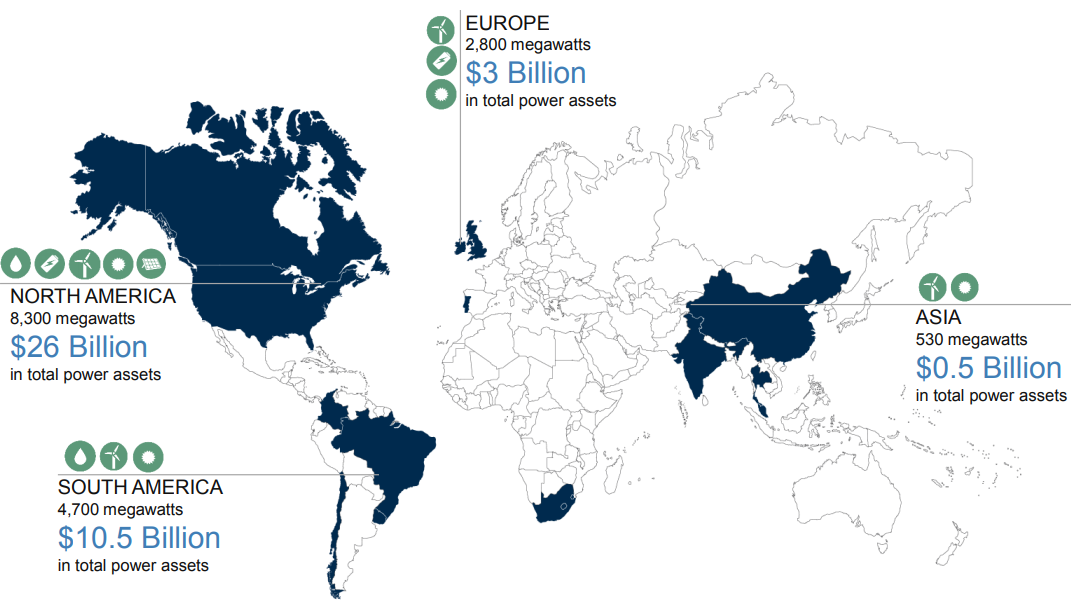

Its portfolio consists of approximately 21000 MW of capacity and nearly 6000 generating facilities in North America South America Europe and Asia. Its investment objective is to deliver long-term. Tax return filing obligation or.

It partners closely with management teams to enable business success over the long term. As an alternative asset manager with 600 billion in assets under management and an over 100-year heritage as owners and operators we are invested in long-life high-quality assets and businesses in more than 30 countries around the world. Invested in long-term value.

Equivalent of a Form T5013. The Brookfield Womens Network is dedicated to attracting developing and motivating a community of women across the firms business groups. Federal income tax law for which no clear precedent or authority may be available.

Schedule K-1 is a schedule of IRS Form 1065 that members of a business partnership use to report their share of a partnerships profits losses deductions and credits to the IRS. The Schedule K-1 is the US. Our objective is to generate attractive long-term risk-adjusted returns for the benefit of our clients and shareholders.

Line 13 on the K-1 has code W 41 and says see attached statement for information.

Tax Information Brookfield Business Partners

Brookfield Business Partners L P 2019 Annual Transition Report 20 F

Brookfield Renewable Partners A Great Option To Play The Global Green Revolution Nyse Bep Seeking Alpha

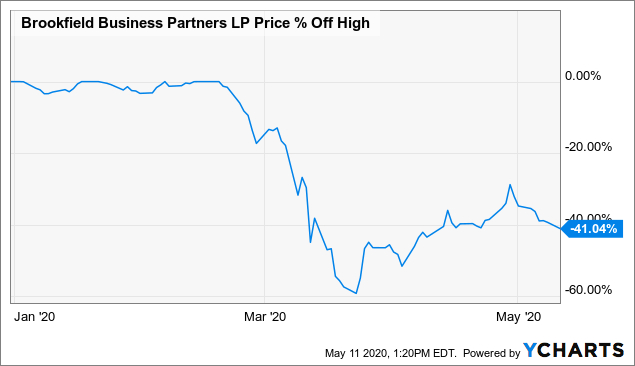

Downgrading Brookfield Business Partners To A Hold Nyse Bbu Seeking Alpha

20 F 1 A2230776z20 F Htm 20 F Use These Links To Rapidly Review The Document Table Of Contents Index To Financial Statements Index To Appendix A Table Of Contents United States Securities And Exchange Commission

Brookfield Infrastructure Partners L P Bip Simply Safe Dividends

The Siren Song Of Brookfield Business Partners Nyse Bbu Seeking Alpha

Brookfield Renewable Partners L P Bep Intelligent Income By Simply Safe Dividends

Form 20 F A Brookfield Property Partners L P Brookfield Asset

Form 20 F A Brookfield Property Partners L P Brookfield Asset

20 F 1 A2230776z20 F Htm 20 F Use These Links To Rapidly Review The Document Table Of Contents Index To Financial Statements Index To Appendix A Table Of Contents United States Securities And Exchange Commission

Brookfield Infrastructure Partners A High Yield Stock With Attractive Assets Intelligent Income By Simply Safe Dividends

Downgrading Brookfield Business Partners To A Hold Nyse Bbu Seeking Alpha

Tax Information Brookfield Business Partners

Brookfield Infrastructure Partners L P Bip Simply Safe Dividends

20 F 1 A2230776z20 F Htm 20 F Use These Links To Rapidly Review The Document Table Of Contents Index To Financial Statements Index To Appendix A Table Of Contents United States Securities And Exchange Commission

Brookfield Renewable Partners L P Bep Intelligent Income By Simply Safe Dividends

The Siren Song Of Brookfield Business Partners Nyse Bbu Seeking Alpha

One More Reason For Investors To Love Brookfield Infrastructure Partners Nyse Bip Seeking Alpha

Post a Comment for "Brookfield Business Partners K1"