How To Generate A K1 Form

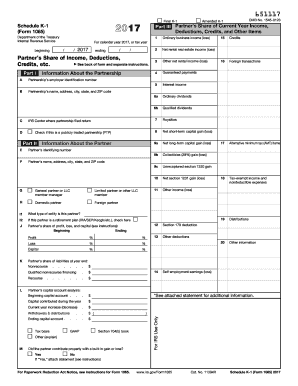

Use Schedule K-1 to report a beneficiarys share of estatetrust income credits deductions etc on your Form 1040. K-1 vs 1099.

3 0 101 Schedule K 1 Processing Internal Revenue Service

If you received a K-1 tax form from a fiduciary you should use it to help calculate your taxable estate or trust income on Form 1040.

How to generate a k1 form. Schedule K-1 Form 1041 is used to report a beneficiarys share of an estate or trust including income as well as credits deductions and profits. Information about Schedule K-1 Form 1041 Beneficiarys Share of Income Deductions Credits etc including recent updates related forms and instructions on how to file. Create an account using your email or sign in via Google or Facebook.

1099 on the other hand is a form that other businesses will send to your partnership if they paid you more than 600 during the tax year. Select your preferred distribution format Save as PDF for email or Print for regular mail and follow. You must report all dividend income on the 1041 and you report the share of dividend income for each beneficiary on Schedule K-1s.

Make use of the Sign Tool to add and create your electronic signature to signNow the Irs form 1041 schedule k 1 2018-2019. Upload the PDF you need to e-sign. If you operate a pass-through entity you must fill out a Schedule K-1 tax form.

Enter your official contact and identification details. A K-1 is a tax document used to report share of profits and losses from interests in limited partnerships. You must furnish a copy of each K-1 to the appropriate beneficiary and attach all copies to Form 1041 when you file the return with the Internal Revenue Service.

These documents become relevant because. Do that by pulling it from your internal storage or the cloud. Schedule K-1 is how individuals in a partnership report their share of the profit or loss.

In order to generate a K-1 eg for an S corp partnership estatetrust using TurboTax you must use TurboTax Business to create the appropriate income tax return. Get Great Deals at Amazon Here. A Guide to Schedule K-1 Form 1041 Inheriting property or other assets typically involves filing the appropriate tax forms with the IRS.

The fiduciary will file a copy of the form. Beneficiaries of an inheritance received a K-1 tax form inheritance statement for the 2020 tax year by the end of. Complete your business return if you havent already done so otherwise your K-1s wont be correct.

In these businesses income tax returns are prepared by the business and then the profit or. Double check all the fillable fields to ensure total accuracy. The shareholders use the information on the K-1 to report the same thing on their separate tax returns.

Add a checkmark to Schedule K-1 Instructions. Httpamznto2FLu8NwSchedule K-1 for Dummies Instructions - How to fill out Schedule K-1 Form 1065 - US. Select the File tab and then select Distribute K-1s.

Learn how to fill out your Schedule K-1 quickly and accurately. What to do with a K-1 tax form. A Schedule K-1 form is used to report individual partner or shareholder share of income for a partnership or S corporation.

A copy of the K-1 tax form should be sent along with your return if your backup withholding is reported on Box 13 Code B. S corporations partnerships and LLCs are considered pass-through business types because the businesss income passes through to the owners on their personal tax returns. Open your return in TurboTax Business.

When you add up the total income from all the 1099s you will get most but not all of the income earned by the partnership during the year. The S corporation provides Schedule K-1s that reports each shareholders share of income losses deductions and credits. Similar to a partnership S corporations must file an annual tax return on Form 1120S.

Export K1 data from a business return to an individual return. Install the signNow application on your iOS device. For tax year 2019 and prior follow these steps to display Schedule K-1 page 2 in Lacerte.

To sign a 2019 schedule k 1 form 1120 s internal revenue service right from your iPhone or iPad just follow these brief guidelines. Schedule K-1 for S corporations. Trust and estate deductions.

When you go to Print Tax Return choose K-1 package only. To issue K-1s to your partners shareholders or beneficiaries youll need TurboTax Business. Under Copy select Addtl K1 Package.

Keep a copy of the K-1 tax form if the IRS happens to have. Select OK to print the Schedule K-1s and the instruction booklet. Utilize a check mark to point the choice wherever expected.

3 0 101 Schedule K 1 Processing Internal Revenue Service

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 0 101 Schedule K 1 Processing Internal Revenue Service

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

K1 Form Fill Out And Sign Printable Pdf Template Signnow

How Schedule K 1 Became Income Investors Worst Enemy The Motley Fool

3 Ways To Fill Out And File A Schedule K 1 Wikihow

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

3 Ways To Fill Out And File A Schedule K 1 Wikihow

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

3 Ways To Fill Out And File A Schedule K 1 Wikihow

3 Ways To Fill Out And File A Schedule K 1 Wikihow

3 Ways To Fill Out And File A Schedule K 1 Wikihow

Post a Comment for "How To Generate A K1 Form"