Business Mileage Rate 2020 Ireland

28 pence per mile. Mileage rate structure involving a reduction in the mileage bands from six to two bands and streamlining the categories of car engine capacities.

Warm Welcome To St Croix With Cruzanrum And The Sweet Sounds Of A Steel Pan Gotostcroix St Croix Traveling By Yourself Warm

The standard mileage rate for business is calculated by using an annual study of the f.

Business mileage rate 2020 ireland. 20 pence per mile. Actual kilometres driven to date will however count towards total kilometres for the year. Importantly employees or directors must be on a business journey from their normal place of work to claim tax free mileage rates and subsistence.

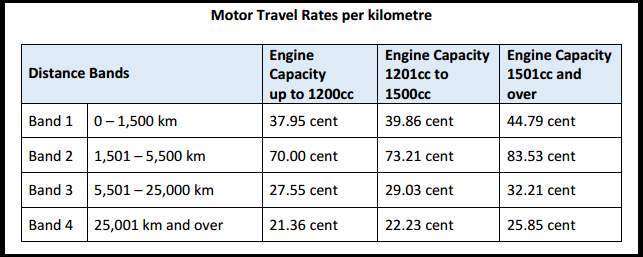

What Is The Mileage Rate For 2021 Ireland. 9 rows The amount of mileage accumulated by an employee between 1 January 2017 and 1 April. Civil Service Mileage Rates.

Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. The new rates and car engine capacities details of which are shown below apply with effect from 5th March 2009. 21 Apr 2017 1052 am.

Where employees use their own private cars or motorcycles for business purposes reimbursement in respect of allowable motoring expenses can be effected by way of flat-rate mileage allowances. There are two types of mileage allowance schemes which are acceptable for tax purposes if an employee bears all the motoring expenses. If youre self-employed in Ireland then youre obliged to file a self-assessed tax return usually by the deadline of October 31 or by the pay and file deadline of Nov 10.

They will affect the private sector too since the rates provide the benchmark for Revenue-approved mileage expense claims for businesses. A new system for claiming motoring expenses will come into force for civil service employees from April 1. Mileage rates are applicable to every Irish business where employees are required to travel for their job.

The first step towards claiming allowable business expenses is to keep a detailed track of them. The Revenue guidelines for the mileage and subsistence rates were updated on 1st of April 2017You can pay your employees expenses when they travel on business. In addition all Civil Service employees have a mileage year based on the calendar year.

The main changes are. 20 pence per mile. It simplifies tracking by automatically using the correct irs standard mileage rates based on the date of your trip.

For example if you had claimed 1400km on 1 April 2017 you. Fri 09 Oct 2020 - 2011. Use other rates not higher than Civil.

Its a return to the rate. Use the current schedule of Civil Service rates. Annual mileage up to 3500 miles standard rate Annual mileage over 3500 miles standard rate All eligible miles travelled see paragraph 1715 and Table 8 Car all types of fuel 56 pence per mile.

Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. There are now 4 distance bands with different rates attached to each compared to 2. This payment can be made tax free by the amount of business kilometres travelled.

This is important because in many cases organizations are required. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate for 2020 and. You can repay your employees when they use their private cars motorcycles or bicycles for business purposes.

The federal per diem rates for Dublin Ireland are 000 per night for lodging and 000 for MIE as of May 2020. Reimbursement rates Use of private vehicles. The kilometres accumulated by an employee between 1 January 2017 and 1 April 2017 will not be altered by the introduction of these new bands and rates.

The Minister says that the mileage rate changes are aimed at benefiting those who use their car extensively for business travel and also to provide a greater proportionate benefit for those using smaller fuel efficient vehicles. Dublin Ireland DoD Per Diem Rates for 2020. 5 pence per mile.

When employers are travelling as part of a business journey employers can pay their expenses. 28 pence per mile. Click for per diem calculator printable per diem information and historical rates.

575 cents per mile driven for business use down one half of a cent from the rate for 2019. Rather than claiming the actual deductions for purchasing maintaining and running a motor vehicle or motorcycle businesses can calculate allowable expenditure using a fixed rate based on mileage. Two new bands introduced lower recoupment rate for the first 1500km.

We consider the rules for calculating the fixed rates and when these are available. The GAA and Gaelic Players Association GPA have agreed on a reduced flat mileage rate of 50 cent per mile.

Romantic Summer Anniversary Session In Green Valley Illinois Kennedy Zach Kara Evans Photographer Couple Photography Poses Anniversary Photography Photographer

Best Western Best Western Hotels And Resorts Best Western Hotel

2021 Honda Cr V Engine Honda Cr Honda Honda Hrv

How To Buy A Luxury Rental Car From The Bankrupted Hertz At A Crazy Low Price Car Rental Luxury Rentals Enterprise Car Rental

Pin By Marilia Meirelis On Vision In 2020 Volvo Volvo Xc90 Dream Cars

Why Buy A 2020 Chevrolet Corvette W Pros Vs Cons Buying Advice

Understanding How To Manage Your Money And Credit Is More Essential Today Than Ever Before Your Credit Hist Smart Money Financial Wellness Financial Education

Honda Compatible Car Led Door Logo Projector Lights 2 Pcs Honda Honda Accord Custom Car Brands Logos

Study In The Uk Wolverhampton University London University Coventry University

Akbar Travels Us Tourist Visa Visa Visa Online Traveling By Yourself

Xpeng Unveils Cutting Edge Features At 2020 Tech Day Business Wire

Best Plug In Hybrid Cars 2021 Drivingelectric

Italpresse Gauss A Norican Technology Has Supplied Its First Chinese Make Die Casting Machine To Huicheng Foundry Ltd Casting Machine Jinan Die Casting Machine

Knowledge Economy In South Africa Di 2020

Top 10 Best Windshield Snow Covers In 2021 Reviews Amaperfect Windshield Cover For Snow Windshield Cover Car Windshield Cover

Orient Travel Sharjah Rolla Rolla Sharjah Orient

Civil Service Mileage Rates Documentation Thesaurus Payroll Manager Ireland 2020

Get The Board On Board Leading Cybersecurity From The Top Down Cyber Security Cyber Security Course Security Solutions

Post a Comment for "Business Mileage Rate 2020 Ireland"