Quickbooks Business Expenses Paid With Personal Funds

After that you can reimburse the company. Enter the amount to reimburse.

Solved Paid Business Expense With Personal Account

My business checking account will be set up in a few days and I would like only have the business.

Quickbooks business expenses paid with personal funds. Sign In Sign Up. In some cases your accountant may recommend that you record the purchase as a loan which uses a liability account. Heres how to do it.

Business expense paid with personal funds. Record the business expense you paid for with personal funds. Sole Proprietorship Expenses paid with Owners Personal Funds.

Small business owners often contribute to their business by purchasing things with their own funds. When you are finished the balance will be negative make a deposit for the total amount and in the account block select. Enter the purchase amount in the Debits column.

I paid for the following expenses with a personal checking account. Owners Withdrawal Mixing business and personal funds. These expenses can be recorded in QuickBooks in one of several ways.

Select Save and close. Paying with Company Funds Transfers. Record the reimbursement as an expense.

Frequently business owners will pay for business expenses with personal funds. How quickly the business will repay the expenses can determine the best way for the client to record the transactions. Now first of all I highly d.

Heres how to record the reimbursement or refund. In this QuickBooks Online tutorial youll learn how to record owners personal expenses paid with company funds along with- Learn about and set up equity ac. Company owners also pay for business costs with private money.

On the second line select Partners equity or Owners equity. Even though you should avoid mixing personal and business funds sometimes it happens. Select Check or Expense.

Provide the amount youve paid. In the category column select partners equity or owners equity. To track this record the transaction in your Company Owes Me account register.

Create a dummy bank account called owners use write checks do not print them they are just a form for entering transactions on that account to enter and pay the billsexpenses. Record a personal expense from a business account. From the New button.

This is the scenario we started out with paying for your kids school supplies and your companys printer cartridges with your personal credit card. Ask questions get answers and join our large community of QuickBooks users. Heres how to record the business expense you paid personally.

Select a bank account to use to reimburse the personal funds. Select Save and close or Save and new. Pay for business expenses with personal funds Enter Personal Expenses.

This shows that the business now owes you this amount. When you use a business account to pay for a personal expense you should record it in QuickBooks. In the category column select partners equity or owners equity.

For a sole proprietor - owner equity or better owner equity investment technically you can not borrow from yourself if you want to be paid back you use equity drawing for that payment. Another way to reflect this in your bookkeeping journals is by debiting those business expenses paid personally and then crediting them under the liability account as Due to Owner. If you are taxed as a sole proprietor or a partnership code the 125 from business checking as owner equity draw.

On the first line select the expense account for the purchase. Lets go over how to record this in QuickBooks. You dont have to add the employee to the vendor list but you can if you like.

To record the purchase with personal funds use the plus menuexpense in the account section. You can also record the business expense as a seed money from the person to the business only to help you separate your personal and business finances in the future. Select a bank account to use to reimburse the personal funds.

Choose your bank account to use to reimburse the personal funds. Enter the same purchase amount in the Credits column. Go to the New button and select Cheque.

Record business expenses you paid for with personal funds. Line one the expense account for what you bought and the amount. If an employee uses personal funds use the steps suggested for when an owner is reimbursed.

In QuickBooks these expenses can be reported in one form or another.

How To Record Business Expenses Paid With Personal Funds In Quickbooks Youtube

Track Expenses The Easy Way All In One Place Quickbooks Canada

How To Record An Owner S Expense Reimbursement In Online Quickbooks

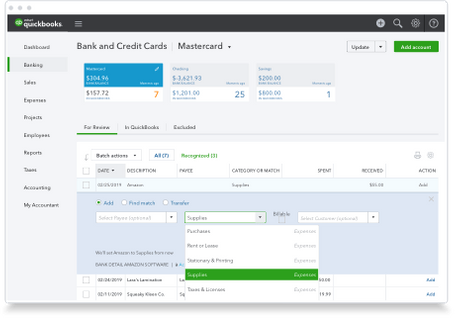

Quickbooks Online Accounting Dashboard Quickbooks Dashboard Examples Quickbooks Online

Quickbooks Tutorial The Chart Of Accounts Intuit Training Lesson 1 9 Quickbooks Quickbooks Tutorial Chart Of Accounts

Solved Pay For Business Expenses With Personal Funds On

Why Keep Personal And Business Expenses Separate The Sensible Business Owner Business Expense Business Basics Tax Time

How Do I Record Business Expenses Paid With Personal Funds In Quickbooks Simply Bussiness News

Inactivate List Items In Quickbooks Desktop Pro Instructions Quickbooks Quickbooks Tutorial Quickbooks Pro

Solved Pay For Business Expenses With Personal Funds On

Why Keep Personal And Business Expenses Separate The Sensible Business Owner Business Expense Small Business Bookkeeping Tax Time

Reimbursing Yourself For Business Expenses

How To Record Business Expenses Paid With Personal Funds In Quickbooks Youtube

Solved Pay For Business Expenses With Personal Funds On

Discover What You Always Wished Quickbooks Could Do Quickbooks Tutorial Quickbooks Business Process

How To Enter Personal Expenses Paying W Company Funds Quickbooks Online Tutorial Youtube

How To Set Up A Chart Of Accounts For Bookkeeping For Dummies Chart Of Accounts Accounting Quickbooks

Comprehensive Quickbooks Online Training With Diane Lucas Quickbooks Online Quickbooks Online Training

Post a Comment for "Quickbooks Business Expenses Paid With Personal Funds"