Are Business Tax Returns Public Record

How could this information not be kept private. Because of this corporate returns are also not available to certain government agencies.

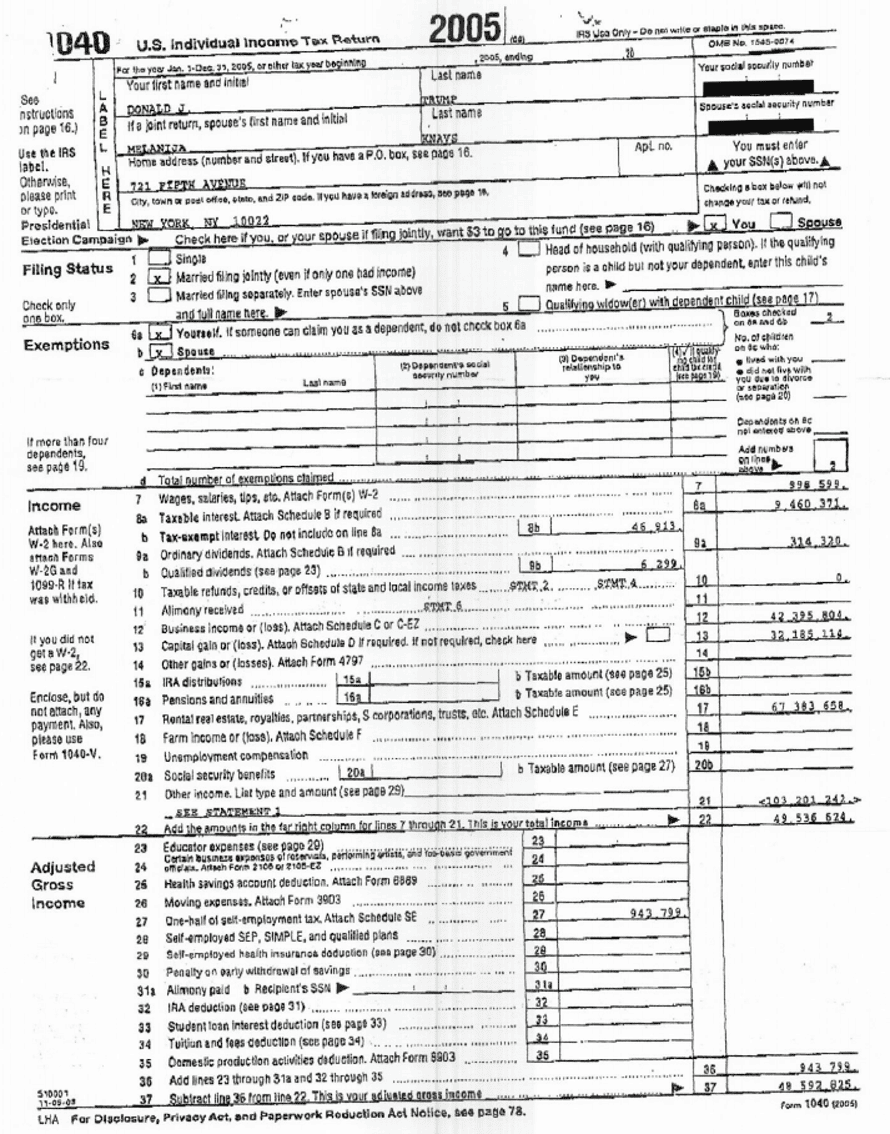

Trump Tax Returns President Had To Pay Millions Due To Tax Law He Aims To Scrap Donald Trump The Guardian

Check our FOIA library for records that were already made public.

Are business tax returns public record. It is also difficult to tell how much a company paid in income taxes from its financial disclosures. Get routine access to IRS records. The short answer is no.

Keep business income tax returns and supporting documents for at least seven years from the tax year of the return. Below are some ways you can get an organizations 990s. Various laws restrict access to taxpayer and business information and exempt these records from the Public Records Act including.

Before 1976 corporate tax returns where classified as part of the public record to varying degrees. Corporations that elect to pass corporate income losses deductions and credits through to their shareholders for federal tax purposes. A relationship existing between two or more persons who join to carry on a trade or business.

But if one persons tax return is of interest to all then maybe all tax returns are. TaxAct Business 1120S includes all the guidance and forms you need to prepare print and e-file a federal S Corporation 1120S return. Learn More.

Corporate tax returns are not public records. To request a copy of a tax return or other documents that you filed individual income tax corporate income tax transaction privilege use tax withholding bonds please complete Arizona Form 450. In 1923 and 1924 individual and corporate taxpayers had to make public their tax payments but not entire returns.

In the first half of the 20th century Congress twice required tax disclosure. Order TaxAct Business 1120S. Order TaxAct Business 1065.

The IRS can audit your return and you can amend your return to claim additional credits for a period that varies from three to seven years from the date you first filed. The IRS requires all US. In some cases these documents are publicly available so anyone can access them.

A legal entity that is separate and distinct from its owners. In this case you need to order it by mail using Form 4506. Every company is required to keep business records for several years.

They must also make public their Form 1023 which organizations file when they apply for tax-exempt status. If youre working with an IRS employee on an open tax case ask them for the information you need. Partnerships however file an annual information return but dont pay income taxes.

If you want to elect S Corporation status you must file Form 2553 and an S Corporation 1120S tax return. Since 1976 there have been occasional calls for the. If you need an actual copy of a tax return you can get one for the current tax year from the IRS for up to the last six years.

Almost every state imposes a business or. Uncover liens judgments bankruptcies and other critical business public records to verify the creditworthiness of customers and partners. Charles Grassley R-Iowa recommended that government alter its regulations to make corporate tax records publicly available.

And in fact Internal Revenue Service tax code prohibits disclosure of tax returns by the government except. Federal corporate tax returns are confidential and protected from public disclosure under Section 6103 of the Internal Revenue Code IRC as enacted by the Tax Reform Act of 1976 PL. Instead each partner reports their share of the partnerships profits or loss on their individual tax return.

Ownership records for example should be permanently retained. Enacted in 1966 the Freedom of Information Act or FOIA gives any person the right to access federal agency records or information. Tax-exempt nonprofits to make public their three most recent Form 990 or 990-PF annual returns commonly called 990s and all related supporting documents.

Most businesses must file and pay federal taxes on any income earned or received during the year. Keep in mind that orders placed online and by phone are processed in 5 to 10 business days. 1 day agoBezos Musk Buffett and George Soros are all public figures rewarded by society and in the public interest.

Corporate tax returns are private simply because they are deemed confidential and are protected under Section 6103 of the Internal Revenue Code as enacted by the Tax Reform Act of 1976. Much of the information collected and held by the Department of Revenue for its customers is confidential and exempt from the Public Records Act. Accounting experts recommend keeping your tax returns for at least seven years.

To request a copy of any other ADOR public record please complete Arizona Form 460. They arent even available to certain government regulators.

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Deductions List

6 Surprising Facts Found In Presidential Tax Returns Through History History

Irs Tax Notices Explained Landmark Tax Group

Pin On Personal Finance Investment

3 21 3 Individual Income Tax Returns Internal Revenue Service

How Long To Keep Tax Returns H R Block

Tax Documents Checklist Papers Organizing Home Organizer Paper Organization Free Printables Organization Organization Printables

Foreign Direct Investment To Incorporate Company In India Tax Return Investing Income Tax Return

3 Ways To Read A Tax Return Transcript Wikihow

Best Nidhi Company Registration At Kolkata Income Tax Return Public Limited Company Tax Return

How To Get A Tax Return Transcript In 10 Minutes Shared Economy Tax

Many Waiting Weeks For Tax Refunds As Irs Deals With Backlog Prepares For Stimulus Checks Wreg Com

3 Ways To Read A Tax Return Transcript Wikihow

Pin By Yvette Geer On Craft Show Tips And Product Ideas Tax Prep Checklist Tax Prep Bookkeeping Business

Why You Should Keep Tax Records For More Than Three Years

3 21 3 Individual Income Tax Returns Internal Revenue Service

Compliance Presence Internal Revenue Service

How Long Do I Need To Keep Old Tax Returns

Tax Return Confidentiality And Disclosure Laws Findlaw

Post a Comment for "Are Business Tax Returns Public Record"