Small Business Administration Veterans Programs

The Office of Veterans Business Developments OVBD mission is to maximize the availability applicability and usability of small business programs for Veterans Service-Disabled Veterans Reserve Component Members and their dependents or survivors. Veterans Business Outreach Centers VBOCs - designed to provide entrepreneurial development services such as business training counseling and mentoring.

Sba Rolls Out 100m Grant Program To Help Small Businesses Recover From Covid Fallout Masslive Com

525 Vine Street Suite 1030.

Small business administration veterans programs. Some of the programs available include. Link is external Phone. And is as an Ombudsman for veteran.

And since 2009 the dollar amount of SBA lending support to veteran-owned firms has nearly doubled. The Veteran Institute for Procurement offers five programs to help veteran-owned small businesses and service-disabled veteran-owned small businesses increase their ability to win government. This small business program features a number of success stories and offers business plan workshops concept assessments mentorship and training for eligible veterans.

Minority Veterans Program. Veteran entrepreneurs can get training and coaching through the Small Business Administration. 65 E State Street Suite 1350.

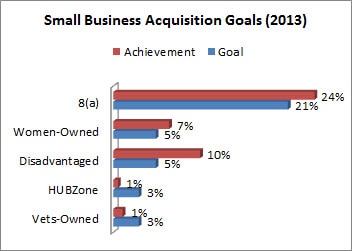

VA Small and Veteran Business Programs implement the requirements to aid counsel assist and protect the interests of small and Veteran business concerns. Overview When acquiring products and services the federal government must award these businesses a fair proportion of total VA property and services purchases contracts and subcontracts. In FY 2013 SBA supported 186 billion in loans for 3094 veteran-owned small businesses.

OVBD is SBAs liaison with the veterans business community. The Department of Veterans Affairs created the Center for Veterans Enterprise CVE which is solely dedicated to assisting Veterans start and build their businesses. If a veteran falls short of a financial institutions requirements to obtain a small business loan through conventional loan programs the Small Business Administrations loan programs provide several types of small business loans.

Provides policy analysis and reporting. The Ohio Veterans Entrepreneurial Training Project was a 2-year pilot training and education program conducted by a consortium of seven two-year colleges in Ohio to assist veterans who are interested in owning and operating their own small businesses. The government limits competition for certain contracts to businesses that participate in the Service-Disabled Veteran-Owned Small Business program.

The term Veterans who are minorities means Veterans who are identified as African Americans Asian AmericanPacific Islander Hispanic Native AmericanAlaska Native and Native Hawaiian. As a minority Servicemember or Veteran you may qualify for a wide range of benefits offered by the Department of Veterans Affairs. Contact your local VA Small Business Liaison and find out if you qualify under a GI Bill program or other educational assistance program.

Veterans were recruited through more than 2500 recruitment packets distributed through Ohio Bureau of Employment Services offices and public. Joining the disabled veterans business program makes your business eligible to compete for the programs. SBA Standard 7 a Loan Program This is the SBAs most commonly used loan program and the most common for veterans.

Find your nearest center. The Veterans Business Outreach Center Program is an OVBD initiative that oversees Veterans Business Outreach Centers VBOC across the country. SBA provides veterans access to business counseling and training capital and business development opportunities through government contracts.

The federal government aims to award at least three percent of all federal contracting dollars to service-disabled veteran-owned small businesses each year. US Small Business Administration. SBAs Office of Veterans Business Development is responsible for acting as a liaison with the Veterans business community for policy analysis and reporting and for acting as an Ombudsman for Veterans in Small Business Administration programs.

7 rows Overview For acquisition purposes small and Veteran businesses must be. Apply for and manage the VA benefits and services youve earned as a Veteran Servicemember or family memberlike health care disability education and more.

Small Businesses Senator Joni Ernst

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Veterans Business Outreach Center Vboc Business Impact Nw

Small Business Set Asides Sam Registration Small Business Certifications

Veterans University Of Georgia Small Business Development Center

Boots To Business Home Facebook

Programs Supporting Small Businesses Hhs Gov

National Veterans Small Business Week Nov 2 6 Vbr Small Business Week Veteran Small Business Resources

Veterans Business Outreach Center Pathway Lending

Grants For Veterans Starting A Business Kabbage Resource Center Kabbage Resource Center

Veteran Owned Small Business Contracting Vosb Sdvosb Aptac

Vboc Veteran Business Outreach Center Ut Arlington Texvet

Service Disabled Veteran Owned Small Business Certification Program

Sba Administrator Takes Heat On Relief Programs From House And Senate Committees On Small Business

Veterans Business Outreach Center Vboc Business Impact Nw

Veterans Business Outreach Center Pathway Lending

Women Veterans Entrepreneurship Training Program Liftfund

Post a Comment for "Small Business Administration Veterans Programs"