How Long Can You Depreciate A Business Vehicle

Depreciation is a tax concept that provides taxpayers the ability to take a deduction for the depreciation of property utilized for business purposes which means that taxpayers can recover the cost or other basis of the property during the period of. For new and pre-owned vehicles put into use in 2020 assuming the vehicle was used 100 for business.

How To Calculate Depreciation Expense For Business Accounting Books Online Accounting Software Buy Business

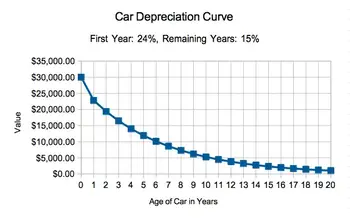

The maximum allowance then drops to 16000 dollars in year two and 9600 in year three.

How long can you depreciate a business vehicle. If the truck or van qualifies for bonus depreciation discussed below and the taxpayer does not elect out the first-year limit amount is increased by 8000. In other words all section 179 deductions for all business property for a year cant be greater than 1 million. The dollar amount is adjusted each year for inflation.

To do this youll have to claim capital allowances. The vehicle must be driven over 50 of the miles for business purposes. You can deduct only a portion of the cost based on the percentage of miles driven for business purposes.

The maximum first-year depreciation write-off is 10100 plus up to an additional 8000 in bonus depreciation. When driving a car for business purposes you can deduct the purchase price of the car over one to five years. A 15 deduction in the year you bought it A 30 deduction each year after the first year Alternatively you can use the ATOs general depreciation rules to work out how much you can claim for vehicles over the threshold.

Under simplified depreciation rules you would pool an expensive vehicle into a small business asset pool and claim. 50 bonus first year depreciation can be elected over the 100 expensing for the first tax year ending after September 27 2017. 10100 for the first tax year 18100 with bonus depreciation 16100 for the second tax year.

The depreciation limits for trucks and vans placed in service in 2014 and used 100 for business are shown in Exhibit 2. The IRS allows up to 25K up front depreciation 100 for SUV over 6000 lbs PLUS 50 Bonus Depreciation for NEW vehicles which will get close to that figure. In the case of motor vehicle the IRS assumes a useful life of five years.

For 2018 the maximum limit on car depreciation using the special depreciation allowance is 18000. You must not have claimed actual expenses after 1997 for a car you lease. The tax rules determine how much you can depreciate a particular vehicle but after a few years of ownership it is likely that you have written off most or all of the cost.

If your business vehicle was put into service anytime in 2018 you get a maximum depreciation allowance of 10000 for the first year. For passenger vehicles the law also increases first-year bonus depreciation from 10000 dollars to 18000 dollars. Here are the greatest allowable depreciation deductions for vehicles placed in service during the calendar year 2019.

Take Action While You Can. How to Depreciate a Vehicle for Business. Rather they seek to gradually deduct their costs over the useful life of the property.

An additional 8000 may be claimed as bonus depreciation the first year. The use of depreciation. Primarily because a business vehicle is an asset not an expense something youll be using in your business for at least a few years.

Depreciation limits for trucks and vans. That said you can still deduct part of your cars value from your profits and pay less tax. Finally the maximum for.

After year three the maximum allowance drops to 5760 dollars per year until the vehicle is fully depreciated. 9700 for the third tax year. Three popular methods for calculating the depreciation deduction are bonus depreciation MACRS and Section 179.

Any Section 179 deduction that is not used in the current year because it is greater than your business income can be carried over to subsequent years. The total amount you can take as section 179 deductions for most property including vehicles placed in service in a specific year cant be more than 1 million. If you are using the simplified depreciation rules for small business you can claim 575 of the cost of the asset in the first year you add the asset to the small business pool.

To use the standard mileage rate for a car you own you must choose to use it in the first year the car is available for use in your business. Then in later years you can choose to use the standard mileage rate or actual expenses. You must not have claimed the special depreciation allowance on the car and.

In the second year the maximum is 16000 and in the third year the maximum is 9600. Businesses and their owners do not generally deduct the full purchase price of capital assets including motor vehicles in the year in which they are purchased.

Car Depreciation For 1099 Contractors And Car Sharers

Car Depreciation How Much Money Have You Lost Livable Budget Budgeting Personal Finance Financial Fitness

Car Depreciation Calculator How Much Will My Car Be Worth

Vehicle Tax Deductions Writing Off A Vehicle For Business Using Section 179 Depreciation Youtube Tax Deductions Deduction Business Investment

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Vehicles And Section 179 Deduction Large Suv Crossover Cars Vehicles

Vehicle Depreciation Explained Perception Of Supply And Demand High Car Perception Supply

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Business Vehicle Depreciation Deduction Mileiq Uk

Business Use Of Vehicles Turbotax Tax Tips Videos

The Top 8 Fastest Depreciating Cars

Car Depreciation How Much Have You Lost New Cars Infographic Car

If You Use Your Car For Business You Definitely Want To See If You Qualify For A Tax Deduction This Guide Breaks Down The Car De Deduction Tax Deductions Car

Rv Depreciation What You Can Expect With A New Rv Purchase Rv Hive Rv Rv Life Used Rvs

2020 Tax Code 179 For Business Owners The Self Employed Carprousa

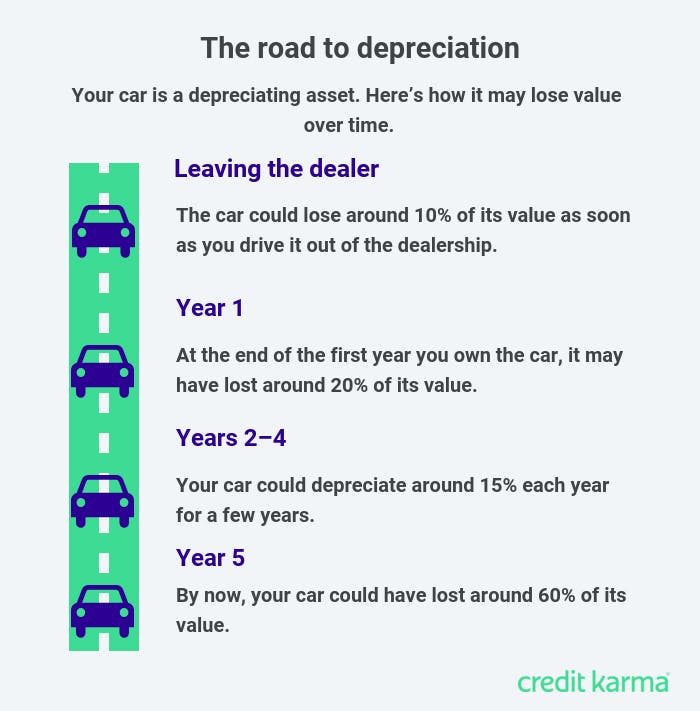

How Car Depreciation Affects Your Vehicle S Value Credit Karma

How Much Does A Car Depreciate Per Year

Post a Comment for "How Long Can You Depreciate A Business Vehicle"