Business Mileage Rate For 2020 Taxes

575 cents per mile for business. BOSTON Mass December 31 2019 The Internal Revenue Service IRS has announced the 2020 business mileage standard rate of 575 cents calculated with data provided by Motus.

2020 Tax Information Standard Deduction Standard Deduction Irs Tax

Beginning on January 1 2020 the standard mileage rates for the use of a car van pickup or panel truck will be.

Business mileage rate for 2020 taxes. 56 cents per mile for business miles this is a decrease of 15 cents from 2020 16 cents per mile for medical or moving expenses this is a decrease of 1 cent from 2020 14 cents per mile driven in service of charitable organizationsthis rate is set by law and hasnt changed from previous years 4. The Internal Revenue Service IRS released Notice 2020-05 providing the 2020 standard mileage rates. Below are the optional standard tax deductible IRS mileage rates for the use of your car van pickup truck or panel truck for Tax Years 2008-2020.

Jan 01 2020 Beginning on Jan. The IRS mileage rates for 2020 for business vehicle use are. To use the standard mileage rate you must own or lease the car and.

Jan 01 2020 IRS Lowers Standard Mileage Rate for 2020. Thats a drop of 05 cents from 2019. You must not operate five or more cars at the same time as in a fleet operation.

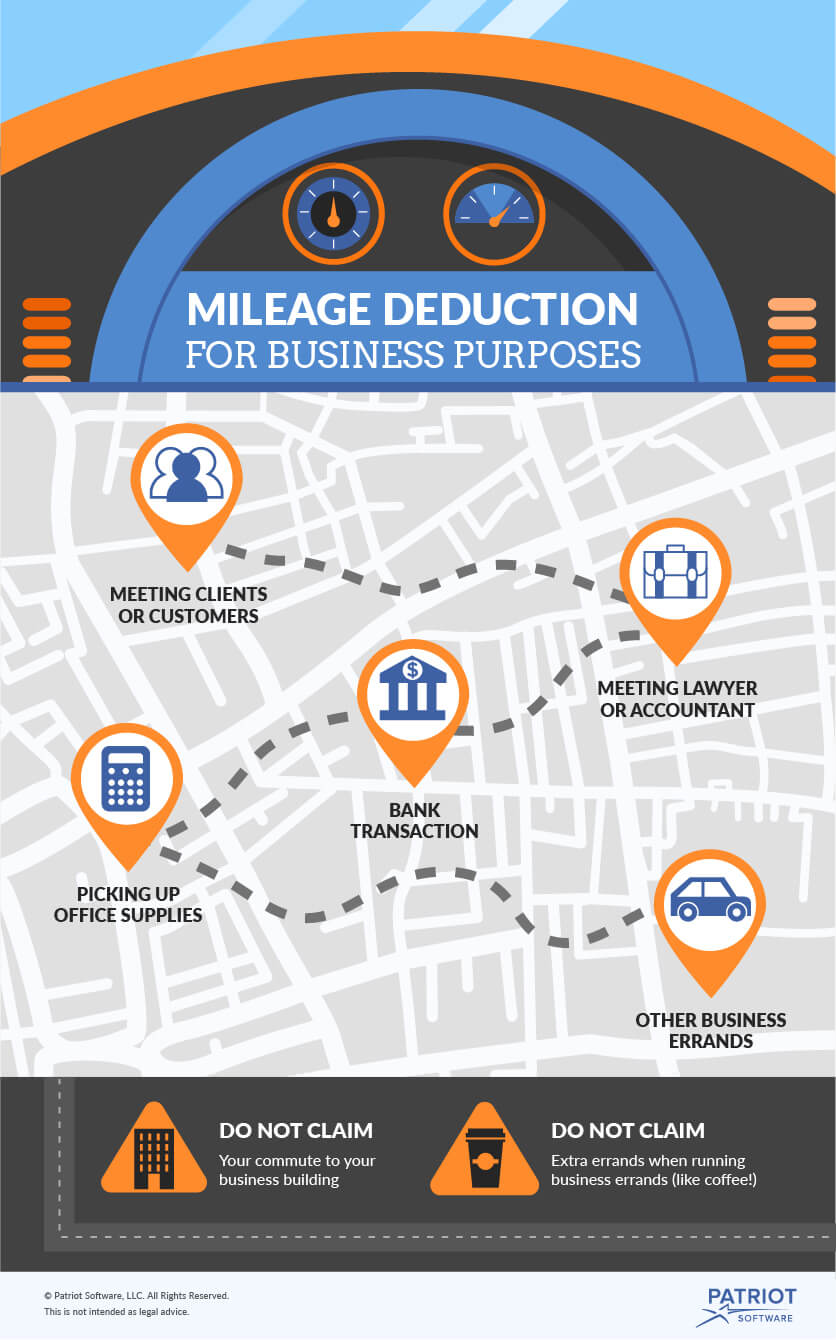

575 cents per mile driven for business use 17 cents per mile driven for medical or moving purposes 14 cents per mile driven in service of charitable organizations. The reasons behind the decrease as in 2019 the standard mileage rate was 58 cents are the following. IRS Mileage Rate For 2020.

14 cents per mile for people working on behalf of charities. The mileage tax deduction rules generally allow you to claim 0575 per mile in 2020 if you are self-employed. IRS Releases 2020 Standard Mileage Rates.

Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. The following table summarizes the optional standard mileage. National average fuel prices have dropped.

575 cents per mile for business miles driven down from 58 cents in 2019. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate for 2020 and. In this case you can claim a standard mileage rate of 575 cents per mile for tax year 2020.

As the definitive leader in reimbursement solutions for businesses with mobile-enabled workforces Motus has deep insights into vehicle cost components. 31 For each business trip record the date starting location starting mileage end mileage and total miles driven for business purposes. 2020 IRS Business Mileage Rate.

As of January 1 2020 the standard IRS mileage rates are as follows. We will add the 2021 mileage rates when the IRS releases them. The rates are categorized into Business Medical or Moving expenses and Service or Charity expenses at a currency rate of cents-per-mile.

The irs standard mileage rate is the standard mileage reimbursement rate set by the irs each year so that employees contractors and employers can use it for tax purposes. Odometer readings on the first day a vehicle is used for business driving purpose and last day a vehicle was used for business purposes in given year. 17 cents per mile to cover moving or medical purposes.

Starting from the beginning of the calendar year the standard mileage rate for vehicles used for work medical and charitable purposes are as follows. 14 rows Standard Mileage Rates. You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if youre an armed forces reservist qualified performance artist or traveling for charity work or medical reasons.

17 cents per mile driven for medical or moving. 575 cents per business mile 17 cents per mile for medical or moving 14 cents for charitable reasons. Thats a drop of 3 cents from 2019.

Jan 01 2020 Beginning on January 1 2020 the standard mileage rates for the use of a car van pickup or panel truck will be. 575 cents per business mile. 17 cents per mile for medical purposes.

Beginning January 1 2020 the standard mileage rates for the use of a car van pickup or panel truck will be. This applies to miles driven starting January 1 2020. 575 cents per mile for business miles driven down from 58 cents in 2019 17.

575 cents per mile of business use. To determine the number of miles driven for business you need two numbers for each business vehicle. The Internal Revenue Service IRS has announced the 2020 business mileage standard rate of 575 cents.

The IRS allows employees and self-employed individuals to use a standard mileage rate which for 2020 business driving is 575 cents per mile. The total number of miles driven during the year The total number of miles driven just for business. Business standard mileage rate treated as depreciation is 24 cents per mile for 2016 25 cents per mile for 2017 25 cents per mile for 2018 26 cents per mile for 2019 and 27 cents per mile for 2020.

Standard Mileage Rate - For the current standard mileage rate refer to Publication 463 Travel Entertainment Gift and Car Expenses or search standard mileage rates on IRSgov. Accordingly the 2020 IRS standard mileage rates are. 1 2020 the standard mileage rates for the use of a car along with vans pickups or panel trucks will be.

Standard Mileage Rates For 2020 Dalby Wendland Co P C

Irs Updates Standard Mileage Rates For 2021 Small Business Trends Small Business Trends Business Trends Irs

2020 Irs Business Mileage Rate Of 57 5 Cents Informed By Motus Cost Data And Analysis

Free Mileage Log Templates Smartsheet

Irs Issues Standard Mileage Rates For 2020 Mileage Irs Eureka

2020 Irs Mileage Rates North Face Logo Retail Logos The North Face Logo

25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Excel Mileage Deduction Templates How Are You Feeling

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Easy Ways To Track Mileage For Your Small Business Sabrina S Admin Services Business Mentor Mileage Business

Claiming For Your Home Office Against Your Taxes Home Office Expenses Business Tax Deductions Small Business Tax

Guide To 2021 Irs Mileage Rates Quickbooks

Free 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Excel Report Template Templates Business Template

Editable 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Wo Mileage Templates How Are You Feeling

Guide To 2021 Irs Mileage Rates Quickbooks

Should You Choose An Enrolledagent Cpa Or Attorney Learn The Difference Between These Tax Practitioners In 2020 Small Business Tax Business Tax Enrolled Agent

Premium Vehicle Auto Mileage Expense Form Mileage Tracker App Mileage Log Printable Mileage Tracker

.png)

Mileage Vs Actual Expenses Should I Track Miles

2020 Standard Mileage Rates Announced Mileage Internal Revenue Service Money Matters

Mileage Tracker Mileage Rates Deductions Quickbooks Small Business Tax Deductions Business Tax Deductions Tax Deductions

Post a Comment for "Business Mileage Rate For 2020 Taxes"