How To Value A Business Based On Revenue Uk

This is the industry average youre going to use. 1925 x 20 38500.

Business For Sale Uk Manufacturing And Distribution Business With E Commerce Platforms 2 Core Revenue Ge Business Valuation Success Business Selling A Business

Third multiply that average profit multiple by the profit of the company youre valuing.

How to value a business based on revenue uk. Profit is your revenue minus expenses. If your business has post-tax profits of one million pounds and has a PE ratio of five you would value it at 5000000. Last 12 Months Profits Owners Salary.

Second calculate the average and the median profit multiple from the data you gathered. How you arrive at the right number for your PE ratio can vary drastically depending on the business. This is the most universally used business valuation method and is often the point of reference for other techniques.

Using the turnover valuation method the calculation would be as follows. Working out the ratio can be done using profits. How to Value a Small Business NerdWallet.

One common method used to value small businesses is based on sellers discretionary earnings SDE. As an illustration using a PE ratio of four for a business that makes 500000 post-tax profits means it would be valued at 2000000. Profit Multiplier In profit multiplier the value of the business is calculated by multiplying its profit.

The time value of money is the idea that 1 earned today will be worth more than 1 gained tomorrow due to its earning potential. You can find this number on the businesss latest profit and loss statement. PE ratios are used to value businesses with an established profitable history PE ratios vary widely.

For example using a PE ratio of five for a business with post-tax profits of 100000 gives a valuation of 500000. To reach an estimated business valuation you add the projected takings forecast for the next 15 years or so plus a residual value at the end of the period. Multiple of earnings value.

To value a company based on profit first you gather the profit multiple of similar public companies. This method can be used to value a business. High forecast growth can point to a higher PE ratio as can a track record of repeat business.

100108 52 weeks 1925 average turnover per week Average multiple for a café is 20 hence. You can value a business by multiplying its profits by an appropriate PE ratio see below. And if a business has a good record of repeat earnings it may have a higher PE ratio too.

Based on these traditional sales-based valuations the business would be valued at 38500. When valuing a business it is usual to use at least two methods and arrive at a value range rather than one definitive figure. Multiple of profits or PriceEarnings ratio This is a good technique for companies with a solid track record of profitability but ratios vary widely.

For example if your companys adjusted net profit is 100000 per year and you use a multiple like 4 then the value of the business will be calculated as 4 x 100000 400000. It is based on the earnings a buyer will be able to extract from the business before interest tax depreciation and amortisation EBITDA. Learning how to value a business is the process of calculating what a business is worth and could potentially sell for.

Add in the owners salary as well before inputting this number into the calculator. For example a full-service restaurant with a liquor license will be worth about 30 annual gross revenue if big if its earning the average bottom line profit for. However a common approach used in most industry sectors is called Earnings Multiples a formula for how to value a business based on a multiple of net profits the PriceEarnings PE ratio representing the value of the business divided by its post tax profits.

5 steps1Unless youre a qualified chartered accountant or a financial wizard you may have made the common mistake of associating asset value with. A less accurate method of estimating the value of a business is to apply a percentage to the companys annual gross revenue. So the best way to accurately value your business is to make fact-based.

Revenue Models The Advanced Guide To Revenue Modeling Fourweekmba Revenue Model Revenue Infographic Financial Strategies

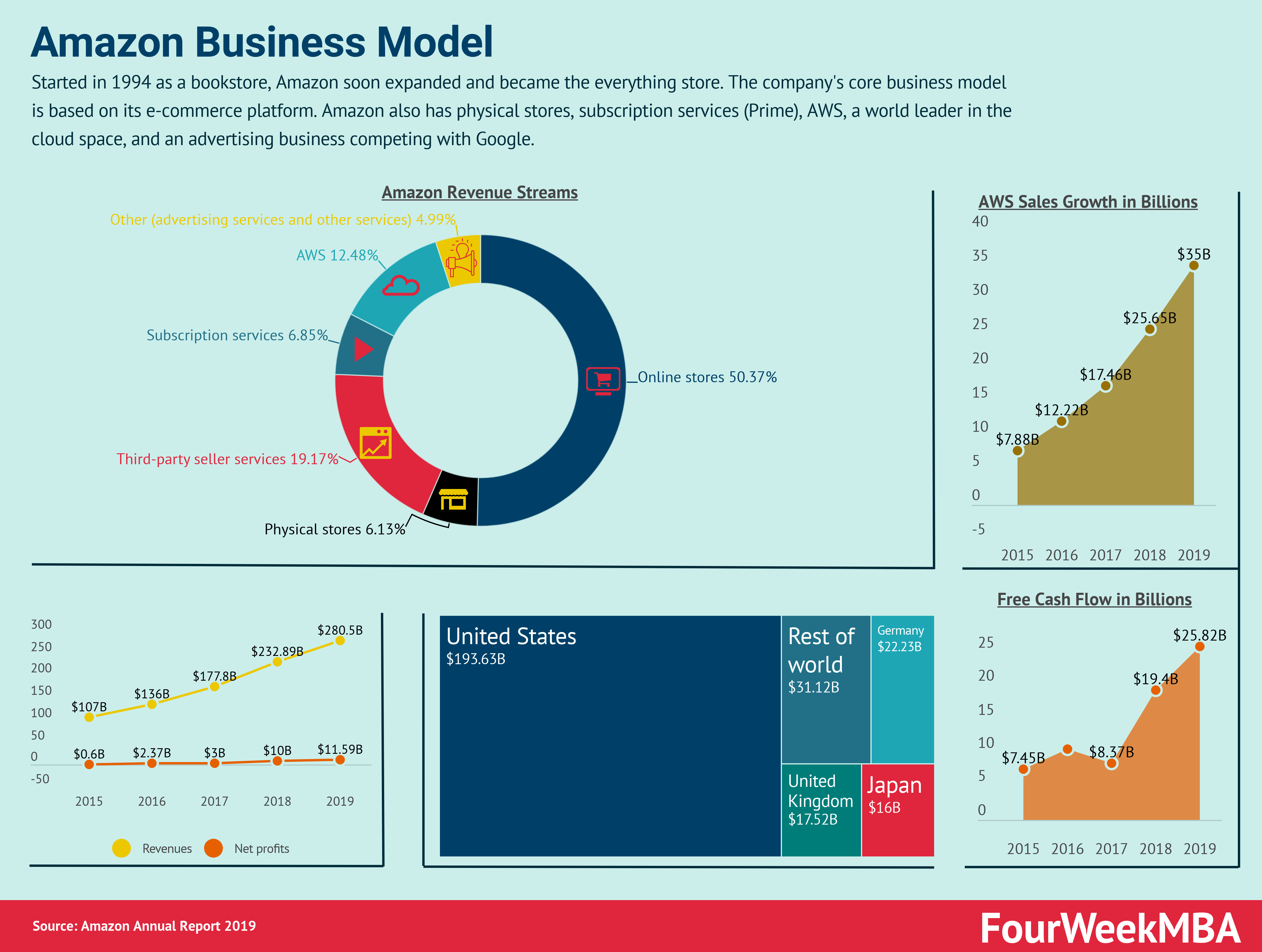

How Amazon Makes Money Amazon Business Model In A Nutshell In 2021 Amazon Business Revenue Model Business Strategy

Digital Advertising Revenue Of Leading Online Companies 2019 Statista

Business For Sale Accessories Business 60 B2b 40 Consumer Ref Ad014 Location Stoke On Trent Staffo Business Valuation Sell Your Business Selling A Business

Hm Revenue Customs On Twitter Business Business Inspiration Business Advice

Handyman Or Repairman Business Management Excel Spreadsheet To Track All Jobs Income Expenses And Handyman Business Business Management Pricing Calculator

Pin By Wafa Manzoor On Business Model Canvas Business Model Canvas Business Model Canvas Examples Customer Relationships

Big Revenues Huge Valuations And Major Losses Charting The Era Of The Unicorn Ipo Revenue Business Valuation Start Up

How Flaws In The Capped Commission Model Are Taking Investors For A Ride Ownersellers Press Release Investors Sell Your Business Estate Agency

Business Model Canvas Revenue Streams Illustrated In This Infographic Revenue Model Business Model Canvas Revenue Streams

How Amazon Makes Money Amazon Business Model In A Nutshell

:max_bytes(150000):strip_icc()/ExxonIncojmestatement2019June-55cdf08720b24bc7b27ade3de5b6dc32.jpg)

What Is The Difference Between Revenue And Sales

Join Our Waiting List For Early Bird Offers Business Valuation Business Analysis Business Growth

Pin On Http Www Abnewswire Com

Download Uk Vat Taxable Turnover Calculator Excel Template Exceldatapro Excel Templates Invoice Template Templates

In Market Business Ref Ag146 Specialist Flooring Supplier Exhibitions Contract Retail Is Updated For Sell Your Business Business Valuation Success Business

Top Quartile Restaurant Valuations 176 Higher Than The Median Enterprise Value Public Company Restaurant

Arm Holdings Business Model Canvas Business Model Canvas Business Model Canvas Examples Business

Post a Comment for "How To Value A Business Based On Revenue Uk"