What Is The Virginia Tax Filing Deadline For 2020

Try Free Fillable Forms. Virginia Tax Filing Deadline is Friday Penalties and interest dont start until June 1st By Rachel DePompa April 28 2020 at 1220 PM EDT - Updated April 28 at 627 PM.

1 Home Twitter In 2020 Child Tax Credit Internal Revenue Service Department Of Veterans Affairs

The latest deadline for Virginia State Income Tax Returns is May 1 2021 May 17 2021.

What is the virginia tax filing deadline for 2020. The state tax filing and payment deadline as well as deadline to pay 2021 estimated income taxes has been moved to June 15 2021 after many were impacted by. The Virginia individual income tax filing deadline is just around the corner Friday May 1 2020. No penalties interest or addition to tax will be charged if payments are made by June 1 2020.

You may still be able to file your return for free using Free Fillable Forms if. 1 2020 is a Sunday you actually have until Monday Nov. If you properly estimate your 2020 tax liability using the information available to you and file an extension form by May 17 2021 your West Virginia annual income tax return will be due on October 15 2021.

Published March 20 2020 by Kate Andrews Virginia is granting a one-month extension for payment of individual and corporate state income taxes by June 1 although tax returns are still due May 1 Virginia Secretary of Finance Aubrey Layne Jr. Ralph Northam D said Friday that he has extended the deadline for filing state income tax returns to May 17 to align it. If you made 72000 or less in 2020 you qualify to file both your federal and state return through free easy to use tax preparation software.

What is the deadline for filing my 2020 taxes. Click httpswwwtaxvirginiagov for more information. If you need additional time to file your individual income tax return there is an automatic six-month extension in.

Friday May 1 2020. The Virginia individual income tax filing deadline is approaching on May 1 however due to the pandemic there is an automatic extension to file. Automatic six-month filing extension.

Due to the COVID-19 pandemic the federal government extended this years federal income tax. Due to the COVID-19 pandemic the federal government extended this years federal income tax filing deadline from April 15 2021 to May 17 2021. So if you owe taxes for 2020 you have until May 17 2021 to pay them without interest or penalties.

31 2020 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a VA state return. Ralph Northam announced Friday that the state Department of Taxation is. 2 to file this year.

Typically most people must file their tax return by May 1. Everyone has an automatic 6-month filing extension in Virginia which moves the filing deadline from May 1 to November 1 for most taxpayers and since Nov. Virginia State Income Taxes for Tax Year 2020 January 1 - Dec.

Virginia Tax is encouraging taxpayers especially those who have a refund coming to file your returns electronically. If you file during the extension period make sure you still pay any taxes owed by June 1 2020 to avoid penalties. Dont qualify for Free File.

Virginia has an automatic 6-month extension to file your income tax 7 months for certain corporations. In addition as part of the states COVID-19 tax relief actions if you owe taxes you have until June 1 2020 to pay without any penalties or interest. If you missed the deadline and owe taxes you should pay as much as you can as soon as possible to reduce additional penalties and interest.

To avoid interest and penalties when filing your tax return after May 17 2021 pay the tax you estimate as due with your extension request. RICHMOND Virginia Gov. Tips for Filing Season.

Filing electronically is the safest and most efficient way to file your return said Tax Commissioner Craig M. The deadline to file the 2020 tax return remains Oct. This extension is automatic and applies to filing and payments.

Virginia Tax is encouraging taxpayers to file. However the extension does not apply to paying any taxes you owe. Income and corporate tax payments due June 1 2020.

For more information about filing your return this year see Avoid Pandemic Paper Delays. However the filing deadline for 2020 individual income tax returns has been extended to Monday May 17 2021. Made 72000 or less in 2020.

First estimated income tax payments for TY 2020. Various federal tax filing and payment due dates for individuals and businesses from February 8 Oklahoma or February 11 Texas and Louisiana to June 14. Virginia grants an automatic 6-month extension to file your individual income tax return.

-- Virginia is giving taxpayers a few more weeks to file their state income tax returns.

Important 2019 Dates For The Self Employed Small Business Bookkeeping Employment Application Small Business Finance

Form 2290 Deadline Is Here Irs Drivers Education Tax Forms

Claim Missing Stimulus Money On Your Tax Return Asap Here S How In 2021 Tax Return Tax Refund Filing Taxes

Prepare And Efile Your 2020 2021 Virginia Income Tax Return

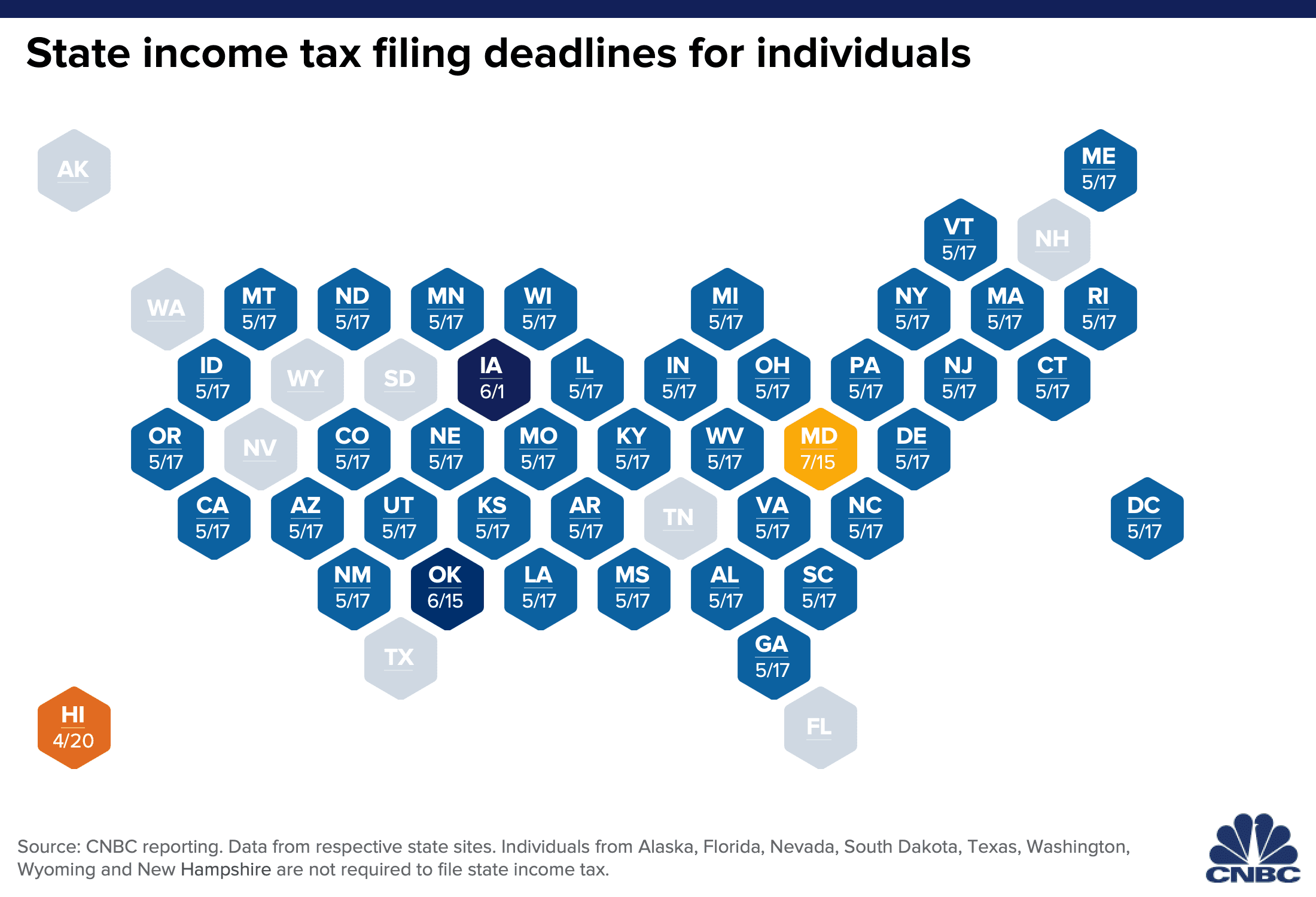

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

Estimated Irs Tax Refund Schedule Dates For 2016 Tax Refund Irs Taxes Income Tax Brackets

2020 Federal Income Tax Deadline Smartasset

National Tax Reports 2020 2021 Tax Refund Free Tax Filing Irs Tax Forms

5 Scary Consequences Of Failing To File Your Taxes Tax Lawyer Tax Return Audit

What You Need To Know About The 2020 Tax Deadline Extension Tax Deadline Small Business Accounting Business Bank Account

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

Federal And State Tax Filing Deadline Delayed

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Turbo Tax By Intuit Turbotax Tax Prep Tax Season

Quarterly Payroll Tax Form In 2021 Payroll Taxes Tax Forms Payroll

Tax Debt Help Chatham Va 24531 Tax Debt Debt Help Payroll Taxes

Post a Comment for "What Is The Virginia Tax Filing Deadline For 2020"