Business Venture Approach Definition

At one end are those approaches that feature essentially low company. For any new business venture there needs to be a good plan.

Making Sense Of Corporate Venture Capital Corporate Venture Venture Capital Small Business Start Up

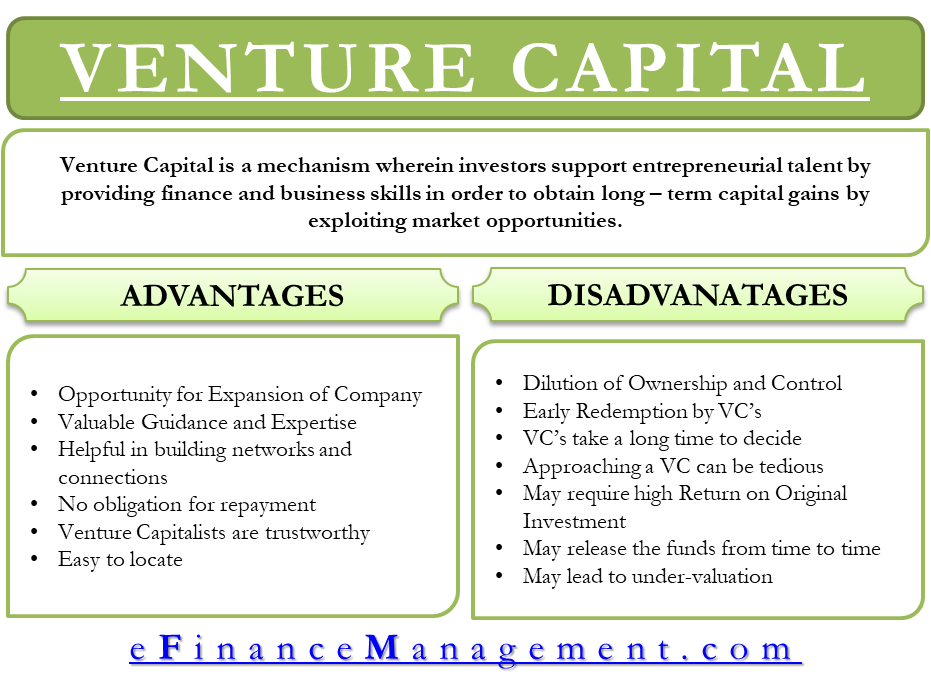

The definition of venture capital is the illiquid investment of capital and resources into a project or company that has a substantial element of risk.

Business venture approach definition. A business venture is any entrepreneurial enterprise thats created to make money. Venture Opportunity Concept and Strategy. A business venture is usually formed out of a need for a service or product that is lacking in the market.

This technique which operates by peeling back layers of the company is designed for use in the preliminary stages of decision-making processes and can be used as a tool for. Corporate venturing also known as corporate venture capital is the practice of directly investing corporate funds into external startup companies. No matter what your skills are you can use them to supplement your income and build new streams of revenue.

The venture drill is the formal process that all entrepreneurs must address when raising money from outside investors. The traditional banking sector is not an option because of the inherent risks of startups. Want to learn more.

The entrepreneur uses a combination of innovation and technology to foster new effective means of activity in all facets of life. This document presents an analysis of the description of a venture. Venture management is a business management practice that focuses on being both innovative and challenging in the realm of introducing what could be a completely new product or entering a promising newly emerging market.

Improve your vocabulary with English Vocabulary. The business venture definition is a new business that is formed with a plan and expectation that financial gain will follow. Ntrepreneurs have important roles in creating new businesses that fuel progress in societies worldwide.

We define entrepreneurial management as the practice of taking entrepreneurial knowledge and utilizing it for increasing the effectiveness of new business venturing as well as small- and medium-sized businesses. Packaging is researching and writing an effective business plan. A business venture aims to fill a gap in the market and has a goal of generating profit.

This is usually done by large companies who wish to invest small but innovative startup firms. They do so through joint venture agreements and the acquisition of equity stakes. SWOT analysis or SWOT matrix is a strategic planning technique used to help a person or organization identify strengths weaknesses opportunities and threats related to business competition or project planning.

Specifically the business plan is a guiding document because it establishes the ventures business objectives strategy and. Many people refer to a business venture as a small business. To define business venture know that it is a startup entity that has been created to generate a profit.

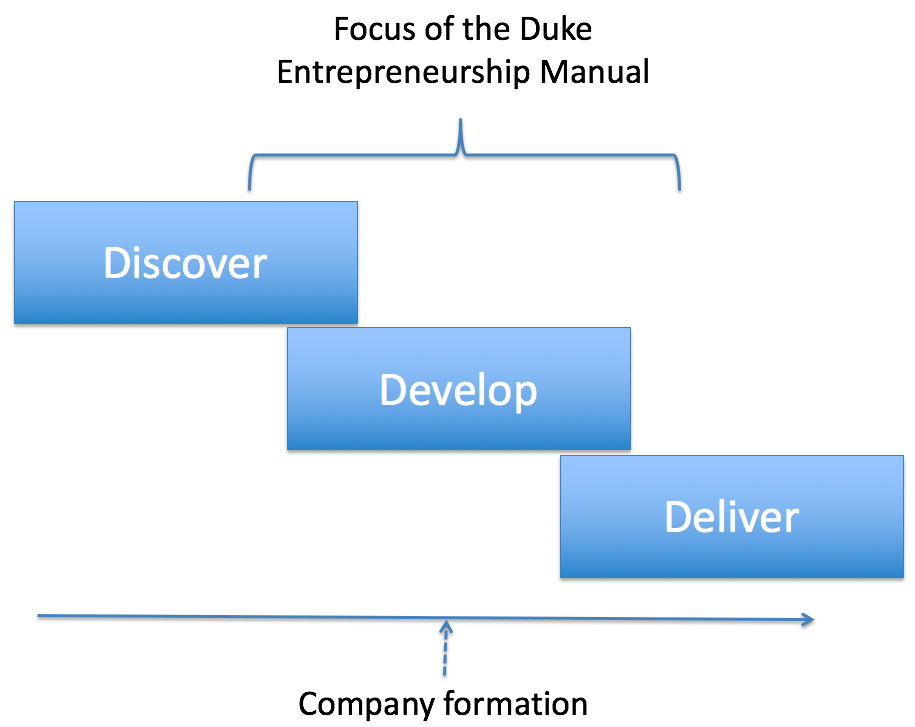

Yes that encompasses a LOT of different things. The way a business venture is funded will depend on the person or the people who create it. The three steps to the venture drill are packaging placing and presenting.

In any new business venture the controlling word is management Therefore for the purposes of our discussions we lean toward management as a discipline for entrepreneurs. Business Ventures at a Glance Entrepreneurship is one of the most challenging yet rewarding career paths. A new business or business activity especially one that involves risk.

Often this kind of business is referred to as a small business as it typically begins with a small amount of financial resources. The business plan for a commercial venture a tool that serves both the internal management needs of the private entity and the informational needs of external entities who are critical to the ventures success. The Spectrum of Venture Strategies Exhibit I displays the range of alternative strategies for launching new ventures.

Placing is skillfully introducing the opportunity before the best investors. In VC our business model is governed by the power law what this means in essence is that out of every ten early-stage investments around two will create all the returns and the rest will. Anything from restaurants to multimillion-dollar Silicon Valley tech startups to even the lemonade stand run by your neighbors kid can be considered a business venture.

The capable entrepreneur learns to identify select describe and communicate the essence of an opportunity that.

Advantages And Disadvantages Of Venture Capital Efinancemanagement

Govtech Business Model Canvas Storm Ventures Business Model Canvas Creating A Business Plan Business

The Venture Studio Business Model Explained Next Big Thing Academy

Mina Mar Group Inc Leading Investor Relations M A Venture Capital Raising Capital Venture Capitalist

Venture Capital Process Venture Capital Investment Process Www Cvivet Org Venture Capital Investing Capital Investment

Private Equity And Venture Capital Course Venture Capital Equity Capital Cash Flow Statement

What Is A Venture Studio Definition And Examples

New Venture Guidelines The Duke Entrepreneurship Manual

New Ventures For Corporate Growth

What Is A Venture Capitalist Definition And Examples

Venture Capital Features Types Funding Process Examples Etc

New Ventures For Corporate Growth

Innovation Design Thinking Approach On Innovation The Business Model Scholar Design Thinking Innovation Infographic

New Venture Creation How Start Ups Grow

New Ventures For Corporate Growth

What Is A Venture Studio Definition And Examples

4 Types Of Entrepreneurship Tips For Women In Business

Incubators Accelerators Venturing And More Innovation Venture Thinking Strategies

Venture Capital Features Types Funding Process Examples Etc

Post a Comment for "Business Venture Approach Definition"